Why Understanding Beneficial Ownership Matters

The terrorist attacks of 9/11 marked a pivotal moment in the realm of international business and regulatory compliance, reshaping the landscape in unprecedented ways. In the wake of these politico-economic events, regulatory bodies responded with profound transformations that underscored the critical importance of stringent compliance measures. Non-compliance became an increasingly costly risk, propelling Anti-Money Laundering (AML) regimes to evolve into more robust and sophisticated frameworks. Particularly during the early 2000s, the Financial Action Task Force (FATF) introduced stringent recommendations aimed at countering terrorist financing and money laundering schemes.

Non-compliance with Anti-Money Laundering (AML) regimes has emerged as a serious threat, potentially plunging countries into dire financial straits. To avert these risks, countries have adopted rigorous measures to operationalize AML regimes, with a laser focus on countering terror financing and money laundering activities.

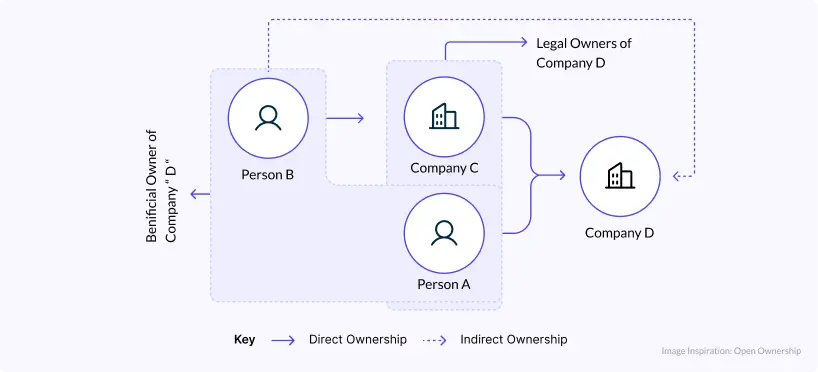

This prevailing trend has significantly intensified the demand for transparency in financial reporting and the identification of Ultimate Beneficial Ownership (UBO). Consequently, businesses face a pressing need for easily accessible and often publicly available data on UBO.

On the flip side, businesses encounter significant challenges in disclosing information about Ultimate Beneficial Owners (UBOs), primarily due to the inherent risks of privacy breaches. Striking a balance between regulatory compliance and safeguarding sensitive data has become a daunting task. As demands for transparency intensify, businesses grapple with the dilemma of meeting compliance requirements while ensuring the protection of confidential information.

Therefore, companies seek compliance regimes that assuage their anxieties and tackle their challenges while ensuring adherence to international and government standards. In this pursuit, the methods of data collection, reporting, and accessibility for Know Your Customer (KYC) and Know Your Business (KYB) purposes hold utmost significance to guarantee compliance. Striking a harmonious balance between fulfilling regulatory requirements and safeguarding sensitive data has become a paramount concern.

Moreover, in KYB, understanding UBO is critical to combat proliferation finance, and funding entities involved in WMD (Weapon of Mass Destruction) development and spread. Identifying UBO in trade and financial transactions helps detect illicit funding and assess risks.

Get your copy

Please enter your information to download the content