A Glimpse into 2023: Real Estate’s Monumental Impact

Before we dive into the intricacies of CDD, let’s take a moment to grasp the sheer magnitude of the Real Estate industry’s influence. The numbers for 2023 paint a compelling picture:

- $113.60 Trillion: The estimated value of the global Real Estate market in 2023, a testament to its colossal size.

- $88.91 Trillion: Residential Real Estate’s dominant position within the industry, reflecting its popularity among investors and homeowners alike.

- 4.70% CAGR: The anticipated Compound Annual Growth Rate of the Real Estate industry from 2023 to 2028, indicating steady expansion.

- Global Pioneers: Key regions, including the United States, the United Kingdom, Germany, China, and Japan, spearheading growth and innovation.

From these financial projections, it’s clear that Real Estate remains a lucrative area for both seasoned investors and newcomers seeking a foothold in the market. However, this prosperity also attracts individuals with less noble intentions, necessitating robust safeguards to protect the integrity of the industry.

The Obligation to Disclose: Customer Due Diligence

Real Estate investors and property purchasers are now obliged to declare their income sources. A regulatory framework that aims to maintain transparency and combat financial misconduct governs most of the jurisdictions that have Real Estate as their main economic cornerstone. At its center, this framework relies on a crucial concept of Customer Due Diligence also known as CDD.

What is CDD in Real Estate?

Customer Due Diligence (CDD) often referred to as Know Your Customer (KYC) acts as a tool to combat money laundering and other financial crimes within the Real Estate sector. Essentially, CDD is a process through which industry stakeholders verify the identities of their customers and assess the potential risks associated with their transactions.

In an era where digitalization and global transactions have become the norm, CDD emerges as the guardian of the industry’s reputation and financial integrity. By ensuring that individuals involved in Real Estate transactions are who they claim to be and that their funds have legitimate origins,

The Importance of CDD in Real Estate Transactions

CDD plays a pivotal role in regulating the real estate industry and preventing illicit transactions:

- Detecting Money Laundering: It helps in identifying and preventing the illicit transfer of funds through Real Estate investments.

- Risk Mitigation: Assessing the risks posed by customers and transactions, allowing for informed decision-making.

- Building trust: It helps in building trust and credibility with clients, investors, and regulatory authorities and is the key to long-term business success.

Also, Read KYC/AML Compliance in Real Estate – Everything You Need to Know

Risks of Neglecting CDD in Real Estate

The Key Components of CDD

1 Parties Involved in Real Estate Transaction

| No. | Party | Role |

| 1 | Buyer | A person or an entity purchasing the property. |

| 2 | Seller | A person or an entity selling the property. |

| 3 | Real Estate Agent | A licensed professional facilitating the property deal (transaction) against a commission. |

| 4 | Financial Institution | The bank or intermediary provides financing for the purchase. |

| 5 | Title Company | Responsible for verifying the property’s title and facilitating the closing. |

| 6 | Regulatory Authorities | Regulatory bodies overseeing compliance with CDD and AML regulations. |

| 7 | Legal Counsel | Providing legal guidance and ensuring compliance with all legal requirements. |

2 Customers in Real Estate Transactions

When it comes to Customer Due Diligence (CDD) in Real Estate transactions, the term customer has a broader definition. It may involve the Buyer, Seller, Real Estate Agent & others who benefit from the real estate transaction. Also, the customers need to be differentiated from the regulators of the real estate business in this case.

3 Beneficial Ownership and CDD

Beneficial Ownership is crucially essential in carrying out the Due Diligence process in the Real Estate business. It declares the actual owner of the real estate assets whether it’s an individual or an entity. Declaring beneficial ownership is a regulatory requirement; in some jurisdictions, it is legally required. Here are the reasons why declaring the beneficial owner is important for real estate investments:

- Maintaining Transparency while conducting a real estate transaction will help maintain the reputation of both customers and real estate agencies.

- KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance requires beneficial ownership for the identification and verification of the customers.

- Tax authorities require the declaration of beneficial ownership to collect property tax.

- Ownership Structure analysis helps in understanding complex money trails that can lead to tracking down money laundering and terrorism financing activities.

FATF’s Webinar on Money Laundering & Real Estate Sector is a resourceful eye-opener on how criminals can exploit the said industry.

4 Risk Assessment

CDD in Real Estate helps assess the potential risks associated with a real estate transaction. By identifying the beneficial owner and evaluating their background and financial history, professionals can assign a risk rating to the transaction. This rating informs risk assessment processes and guides risk mitigation strategies. Finally, a Suspicious Activity Report (SAR) is filed to the regulatory authorities for further investigation of the flagged transaction.

5 Documents Required for CDD in Real Estate

An extensive list of documents is required for the CDD process in real estate transactions.

- Government-issued IDs including ID cards, Passport, and Driving License

- Proof of Address including utility bills and bank statements

- Business Registration Documents including company registration certificates, partnership agreements, and trust deeds

- Financial Statements including tax returns, credit reports, and other financial documents proving the credibility of the parties involved

- Beneficial Ownership Information including ultimate beneficial owners of the corporate entities, and trusts

- Property Documents including deeds, titles, purchase agreements & transfer letters

- Transaction documents including the sale/purchase agreement, financial agreements, and escrow agreements (if any)

- Professional licenses including broker’s license, real estate agent license & certifications

- Sanctions and Watchlist checks including the screening of individuals against government sanction lists, watchlists for terrorists, and PEP (Politically Exposed Person) database

- Power of Attorney is essential in real estate transactions including the POA document and associated identification of the grantor and attorney-in-fact necessary

6 Ongoing Monitoring & CDD

Real Estate transactions require continuous monitoring for identifying the suspicious patterns that indicate potential money laundering activity. This process is called Ongoing monitoring of transactions. It includes transaction monitoring, enhanced due diligence (EDD)

AML Laws and Real Estate

A report by FATF explains the risk of Money Laundering and Terrorism Funding in the real estate sector as follows:

- 37% of countries are found to be at high risk of ML/TF as compared to 9% which are at low risk in the real estate sector.

- As of 2021, 78% of countries have poor to very poor levels of understanding of ML/TF risks in the real estate sector.

- The available statistics increase the importance of understanding of ML/TF risk by jurisdictions & implementation of FATF recommendations.

- These risks need to be mitigated by the countries to respond to sector-specific threats of money laundering and terrorism funding.

- The implementation of CDD and beneficial ownership measures are poor in the real estate sector in relation to other DNFBPs (Designated Non-Financial Businesses and professions)

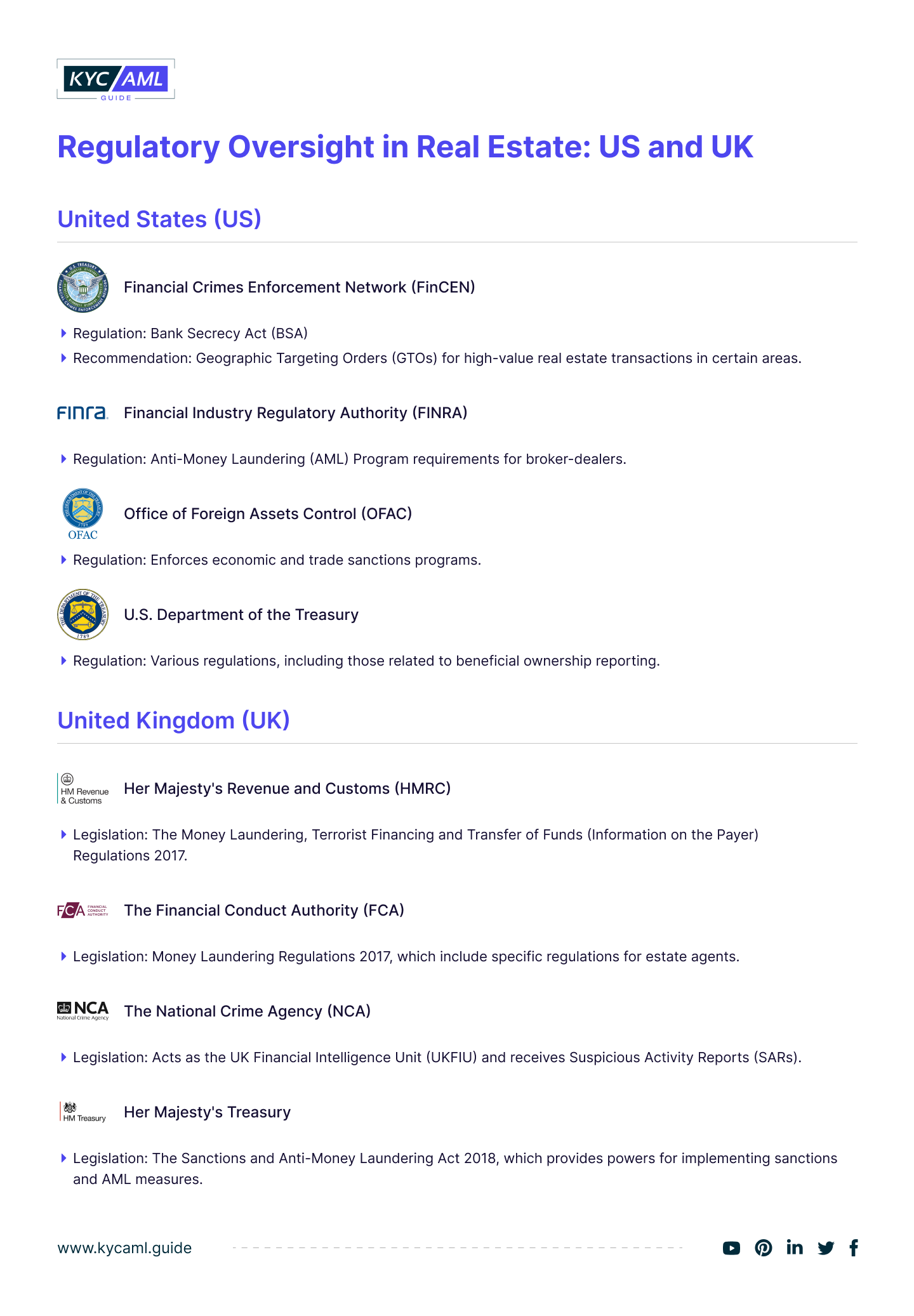

Despite the alarming figures of the real estate sector in AML compliance, the regulatory framework in the US and the UK is actively working to prevent financial crimes in the real estate sector. The following are the main regulators and regulations for Real Estate:

Conclusion

The Real Estate sector offers high levels of profits and lucrative investment opportunities to everyone who seeks a secure financial future. The rising risks of Money Laundering & terrorism financing through real estate transactions require a proper mitigation strategy. Therefore, regulators mentioned in the list above are laser-focused on devising a foolproof real estate regulatory ecosystem to swiftly detect and apprehend money laundering.

How KYC/AML Guide Enhance CDD?

KYC/AML Guide helps in professionally comparing the best KYC/AML solution provider to save you from the hassle of making smart choices. Whether in the real estate sector or any other DNFBP, our platform empowers you to make informed and cost-saving decisions for CDD in real estate and other transactions.