What is In-Person Verification?

Financial institutions and other entities perform in-person verification (IPV). It involves physically meeting the person and visually verifying the identity through information in the KYC documents like passport, driving license, Aadhaar card, etc. IPV is an important step in the KYC process, ensuring that the person’s identity has been carefully verified before becoming a customer. As per Securities and Exchange Board of India (Sebi) rules, from January 1, 2011, every investor, including NRIs, Indians, and sailors, has to undergo IPV before investing in a mutual fund.

Video KYC represents a revolutionary approach to remote digital in-person verification, providing users with a quick and secure way to complete KYC verification without visiting a physical location.

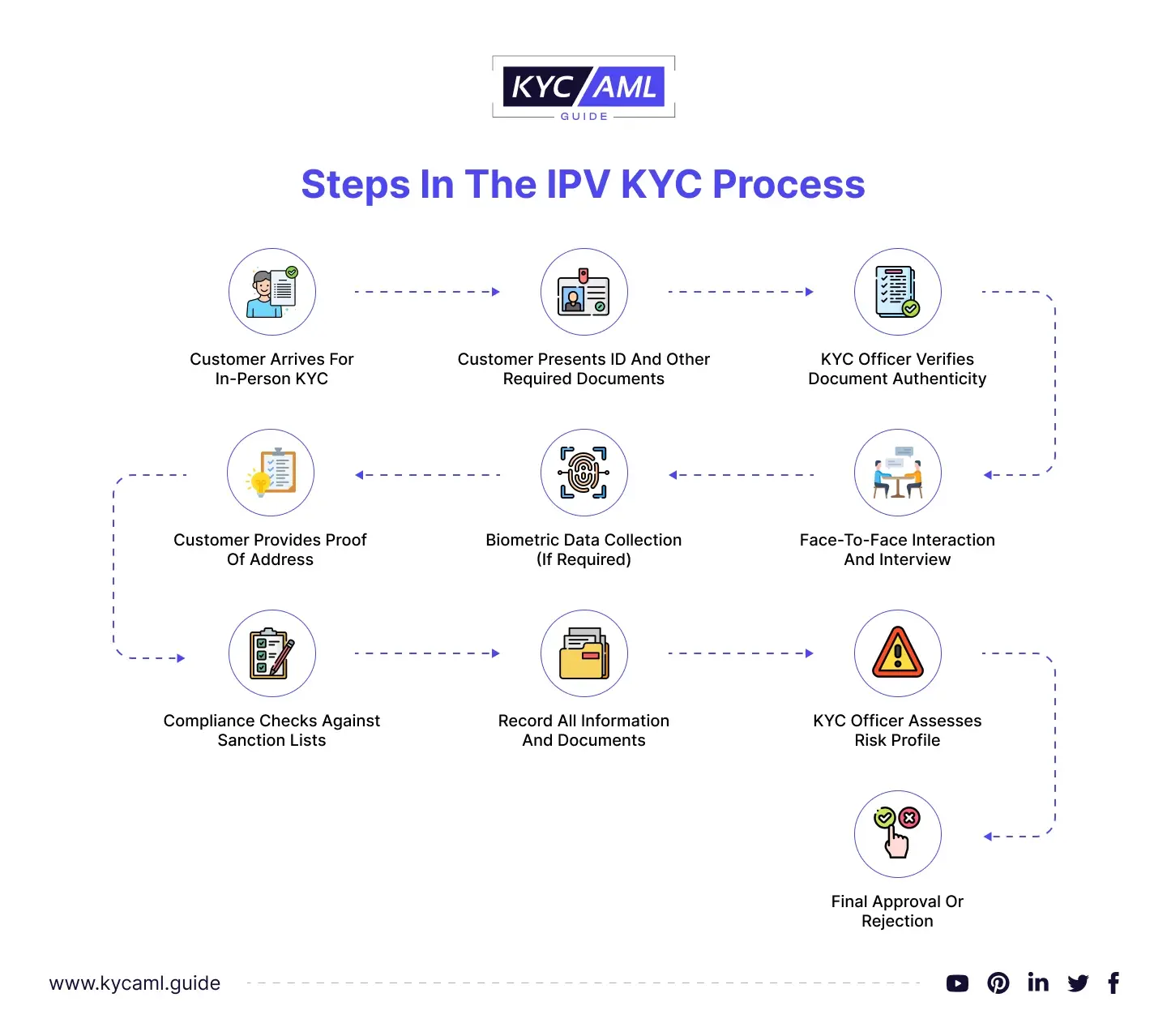

The Process of In-Person Verification

The customer has to provide documents proving their identity like proof of identity and, proof of address, etc. The organization must verify all documents before proceeding with KYC. IPV can also be done through video calls using web tools like Skype, Google Meet, etc. The following steps are done to conduct IPV.

The Benefits of In-person Verification

IPV verification presents a multitude of advantages

1. Enhanced Identity Verification

Companies can inquire and verify that the person providing the ID is the real owner, this reduces the risks associated with fake identity and document fraud. Interviews provide an opportunity to observe nonverbal cues and behaviors that may indicate potentially misleading intentions, such as fear or inconsistencies in information

2. Improved Document Verification

Physical review of documents, such as passports, driver’s licenses, or utility bills allows detailed analysis of red flags that digital scans may miss. Users can provide additional documents or information if any disputes or questions arise during the KYC verification process.

3. Risk Mitigation

In-person verification helps reduce the risks associated with identity theft, money laundering, and financial crime. It protects clients and partners from risk.

4. Improved Due Diligence and Risk Management

Through in-person verification, organizations can improve customer due diligence and strengthen risk management processes. It ensures strong protection against potential hazards.

5. Enhance Trust and Security

Customers can feel comfortable and confident in sharing personal and financial information, which increases confidence in the company’s commitment to protecting their data. Consent in a controlled environment reduces the potential for information to be obtained or misused compared to online submissions.

Bottom Line

In-person verification has many advantages in KYC procedures, including better identity verification, better document verification, and higher levels of trust and security. While digital methods offer convenience and efficiency, the unique benefits of face-to-face interaction make in-person verification a valuable part of a KYC process. Financial institutions should consider implementing in-person in cases where accuracy, security, and compliance are paramount to provide a robust and reliable approach to customer identification.