What is KYC Remediation All About?

KYC remediation involves reviewing and updating customer information and documentation to ensure compliance with the latest regulations. KYC remediation is an essential component of customer due diligence (CDD) measures that complete the customer identification and risk assessment cycle and maintain the accuracy of customer data.

Customer Due Diligence (CDD) plays a significant part in the KYC remediation. It assists with assessing transaction risk, complying with AML regulations, ensuring the precision of client data, and preventing financial fraud. Financial institutions can increase customer and regulator trust, manage risk more effectively, and improve compliance by successfully integrating CDD. This essential aspect should not be overlooked when improving and upgrading your KYC process.

Important considerations for KYC remediation include:

- Keeping track of document findings helps companies understand and evaluate customer risks.

- Confirming and verifying a customer’s identity builds a company’s credibility and reputation.

- Appropriate KYC remediation prevents legal and financial consequences of non-compliance.

- Identifying potential fraud risks such as money laundering and identity theft protects the business and its customers.

- Ignoring KYC remediation can result in fines, lawsuits, reputational damage, and loss of revenue

Three Tips For Financial Institutions

Plan Ahead: Beginning with a Clear Vision:

While you’re busy tackling KYC remediation, have you thought about how many different types of customers you’re working with and how many records you need to update?

All these questions and the deadline to complete the project often lead to confusion. Clients frequently provide vague numbers for all client entities in the hundreds or thousands, but only some comprehend the full scope of the work that must be completed. To sort out what amount of time the remediation cycle will require and what sort of staff you’ll require, it’s critical to know the number of client records you really want to tidy up. A better understanding of the kinds of customers you’re dealing with can also help you streamline the process and better allocate resources. Understanding the complexity of remediation will affect the process and ultimately the schedule. As questions arise

- What specific challenges are likely to arise during the remediation process?

- Is Customer Due Diligence (CDD) or Enhanced Due Diligence (EDD) required?

- Is this a remediation process or just an update?

- How will the volume of records needing attention impact the timeline and resources required?

- Do we have a backlog of tasks to tackle?

All of these are important elements of a reliable forecast. Simpler methods can be used to estimate the remediation effort required and accurately estimate how and when legal deadlines will be met. For example

- Review your past projects: How long did they last? What challenges did you face?

- Task Division: Lists all tasks involved in the remediation process. Estimate the time needed for each task based on your team’s experience and expertise.

- Resource allocation: Determine how many people will work on damage control and their availability. This can give you an idea of the overall effort required.

- Consider complexity: Consider the complexity of the remediation. Are there unique challenges or additional steps that could affect the timeline?

- Set Milestones: Set important milestones or checkpoints to track progress. This will help you stay on track and make necessary adjustments.

Forecasting is complete, it’s time to plan the remediation process.

Also Read: Stay Ahead of the Curve with Effective KYC Remediation Strategies

Establishing a Clear and Streamlined Process:

This process is important for successful remediation. Many of our customers use outdated systems and processes that can reduce efficiency. Regulatory deadlines and potential fines add pressure to make improvements early. This means process problems can be catastrophic. It is important to map the entire process and communicate with all stakeholders on the front and back lines. All roles and responsibilities must be defined and communicated to everyone. Anyone new to end-to-end processes needs to be trained and equipped to handle them.

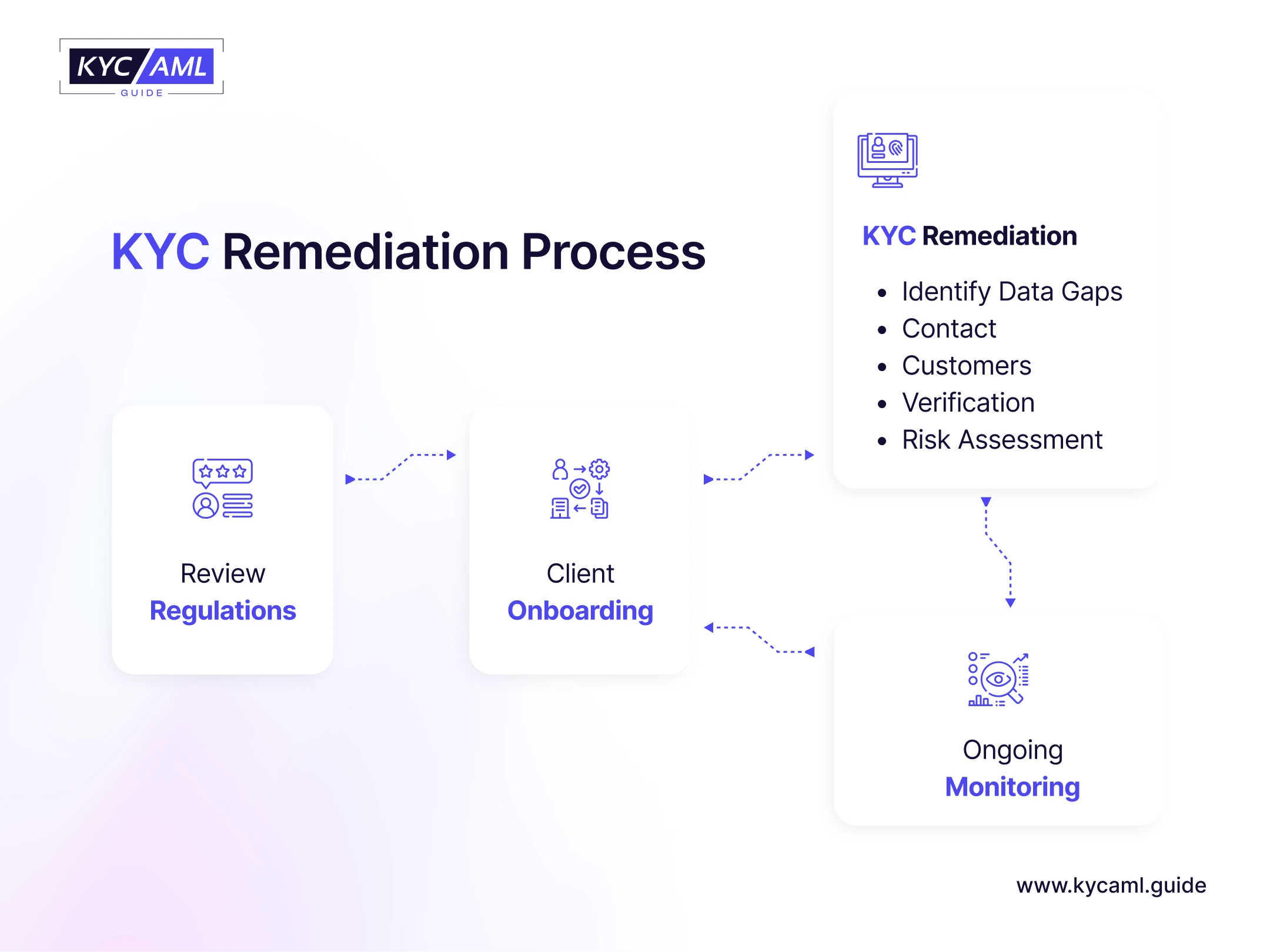

These are the basic steps of the KYC remediation process

Now that you’ve set expectations, planned and communicated the process, and everyone is trained, what’s the next step?

Also Read: 5 Key Steps to Optimize Your KYC Remediation Process

Make People Your Priority:

All activities must put people at the center, from the customer requesting remediation to the remediation analyst processing and evaluating the case. From relationship managers who collect customer data to audit teams who monitor compliance. The community is involved in every part of the process. And they typically span multiple departments, locations, and jurisdictions, all with the best intentions, but each with their daily operations.

Customers sometimes respond. Relationship managers must constantly communicate with other customers. The control group should be the first line of defense. Remediation analysts try to recover as many customers as possible. Everyone has competing priorities, but everyone wants the same results. People’s involvement, communication, and empathy are essential.

Bottom line

As we conclude, it is clear that customer due diligence (CDD) plays a key role. You can improve your remediation approach by starting with a clear plan, improving your processes, and by putting your people first. This not only ensures compliance but also builds trust and strengthens customer relationships. Remember, combining this strategy with an effective CDD is the key to success in today’s financial environment.