Introduction

In today’s fast-paced digital world, Know Your Customer (KYC) verification has become a cornerstone process across various sectors, including but not limited to, finance and healthcare. KYC serves as a crucial mechanism to authenticate the identity of individuals and organizations, mitigating risks associated with fraud, money laundering, and unauthorized access to sensitive information.

Financial institutions worldwide have recognized the significance of KYC procedures in safeguarding against financial crimes such as money laundering and terrorist financing. The verification process involves confirming the identity and background of customers to establish secure and compliant business relationships. As FIs grapple with the challenges of illicit activities, KYC has taken center stage in their compliance and risk management strategies. In fact, the demand for seamless and secure transactions has propelled the transition to digital verification methods, driving innovation in eKYC solutions.

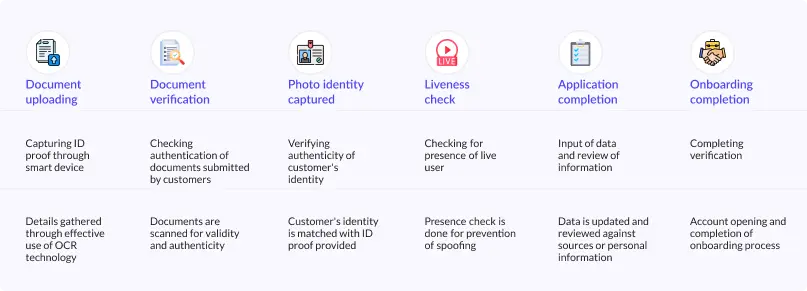

The transition from traditional KYC methods to electronic KYC (e-KYC) is gaining momentum, driven by customers’ demand for seamless digital experiences and the need for greater efficiency in verification processes. E-KYC leverages technologies like biometrics and national ID authentication to expedite the KYC procedure while ensuring enhanced security and customer satisfaction.

Governments and regulators are stepping forward to facilitate the integration of e-KYC, introducing guidelines and policies to streamline the onboarding process and foster a more collaborative and standardized approach worldwide. Furthermore, the Covid pandemic underscored the urgency of e-KYC adoption, prompting regulatory bodies to issue revised guidelines to support business continuity and contactless customer verification.

The global e-KYC market is expected to reach multimillion USD by 2030, with an unexpected Compound Annual Growth Rate (CAGR) during the forecast period. Key manufacturers in the e-KYC market worldwide, such as Jumio, Panamax Inc., Onfido, Wipro Technologies, Innovatrics, and Acuant, are contributing to its growth.

Notably, North America, particularly the United States, is anticipated to play a pivotal role in the development of the E-KYC market. Meanwhile, Europe is showing significant growth in CAGR during the forecast period, indicating promising prospects for the industry’s expansion in that region.

Get your copy

Please enter your information to download the content