Entrust engages Onfido in Exclusive Discussions to Acquire the firm for $400 Million

On February 7th, 2024 Entrust a globally recognized identity management company decided to acquire a British IDV solution provider ‘Onfido’. Discussions are initiated that set a course in combining the two powerful technologies with one motive; to fight money laundering, fraud, and identity theft through enhanced identity verification enabling AI-based biometric and document verification for KYC of enterprises, consumers, and citizens. Entrust has realized the importance of empowering its existing KYC system by injecting a boost of Onfido to mitigate the rapidly surging deepfakes and synthetic identity fraud. Yet the impact of this planned acquisition needs unearthing.

Let us find out what are the possible outcomes of this acquisition for Entrust, Onfido, and the KYC IDV Industry itself.

According to the news report, Todd Wilkinson who is President and the CEO of Entrust announced,

“Entrust has plans to acquire Onfido, citing their belief in Onfido’s top-notch IDV team and technology. They highlighted the importance of advanced identity verification in the face of AI-based threats like Deepfakes, emphasizing its role in securing digital interactions across industries. Entrust sees the acquisition as a chance to provide unmatched identity security solutions to enterprises and institutions globally.”

Onfido built its trust in customers by offering digital identity verification solutions since 2012. With over 500 employees and a recurring annual revenue of $130 million, Onfido has some of the world’s leading financial institutions as its customers prominently in the areas of e-commerce, gaming, and sharing economy platforms. Through AI-powered KYC, Onfido stands out as a leading name in identity verification which is one of the main competencies picked by Entrust in this acquisition decision.

Why the AI Hype?

Onfido’s Atlas is an AI-powered that is known for fully automating end-to-end identity verification with high accuracy and speed results. Artificial Intelligence is the weapon of choice for both good and bad actors. Deepfakes are mostly made through AI software and most of advanced Identity Theft tactics are also AI-based. This is why KYC Vendors like Onfido have worked for more than a decade and developed AI-based IDV to swiftly detect and reduce fraud without compromising the solution’s efficiency in seamless customer onboarding.

KYC AML Guide’s Evaluation of Onfido

KYC AML Guide has built the foundation for guiding Fintech firms like Entrust and other clients in choosing the right KYC Partner. We have tested Onfido and other similar solutions on multiple metrics that paint a detailed picture of a KYC Solution’s capabilities of smart and effective customer onboarding.

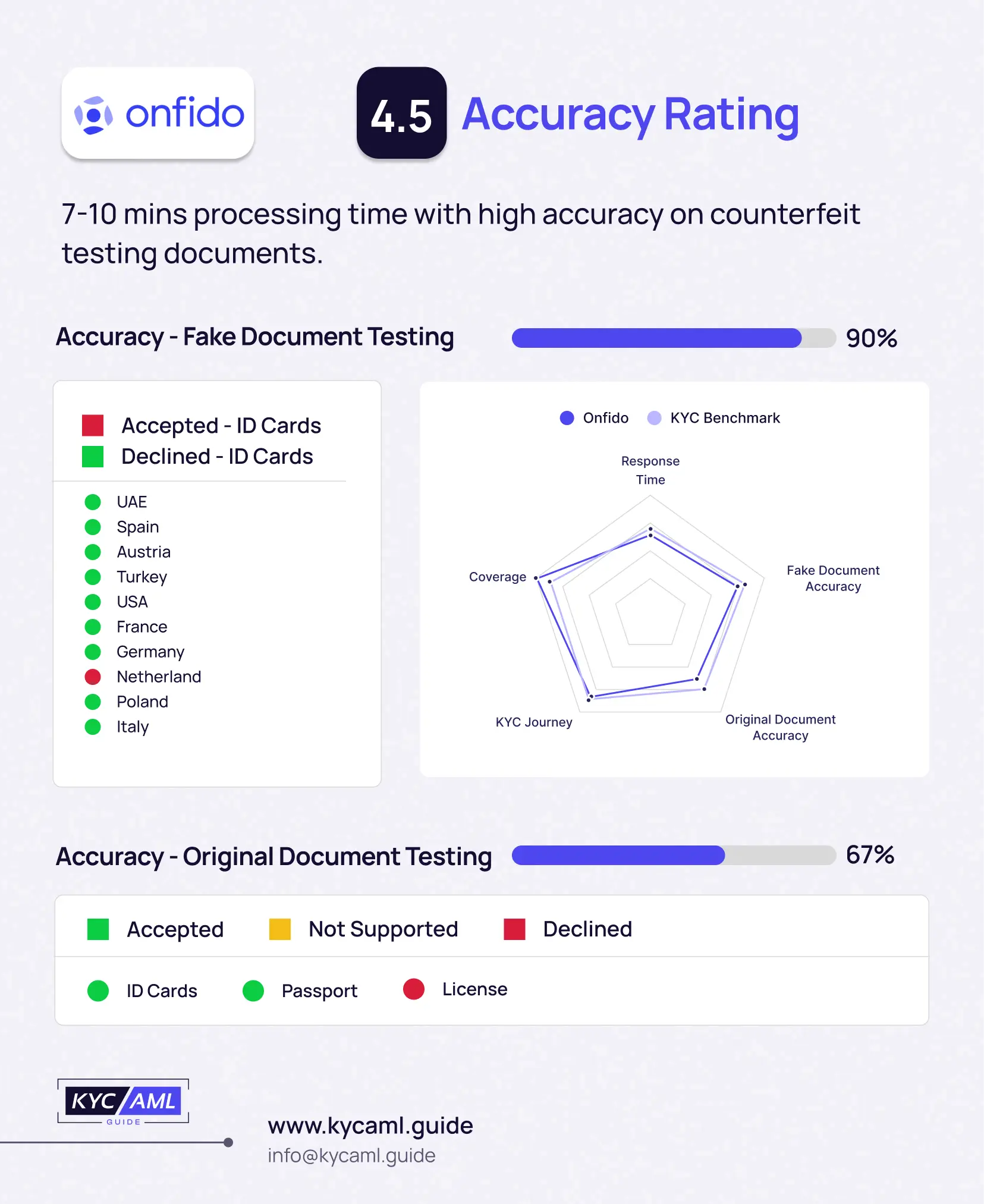

Fake Document Testing & Original Document Testing

We rated Onfido 4.5 in accuracy by testing its capabilities of Fake and Original Document Testing. Out of 10 ID cards of different countries only the Netherlands was accepted resulting in 90% accuracy in Fake Document Testing. However, the original document testing turned out to be at 67% giving a relatively low score. Both these metrics indicate that Onfido is highly efficient in detecting fake identities but quite inefficient in serving genuine customers and may create friction for authentic customers while onboarding.

User Journey

We tested the Desktop and Mobile User Interface of Onfido’s IDV application. For the Desktop we rated it 4.5 and for the Mobile version, we rated it 4.6. Overall the UI/UX of Onfido seems efficient equipped with a modern interface using facilitating icons and mobile continuation features. It also has a simple and clear user flow with pop-ups. Though with few improvements, it can take the lead.

Support

For client support, we rated Onfido 4.4 with a response time of 2-3 hours which offers adequate resolution procedures. Also, the back office support is somewhat acceptable however the reCAPTCHA (for countering bot attacks) and copyrights are not shown.

Apart from the above-mentioned meticulous analysis, we have also tested the integration for the following factors:

- Evaluate integration with comprehensive AML databases

- Check for an efficient case management system for handling and reporting of watchlist hits

- Analyze real-time screening proficiency of Adverse Media

- Review risk scoring configurable

- Review extensive documentation on APIs, and SDKs for solutions’ capabilities to integrate with other systems.

- Ensuring compliance with jurisdictional privacy and data protection regulations

Out of 16 available integration methods 8 are available for Onfido including IOS, Android, React Native, etc. We have also compiled other integration factor-based information for KYC Vendors like Onfido including:

- Third-Party integration facility

- Documentation Details

- Verification and other specifications

Given the Compliance Perspective, Onfido has a total of 52 compliance certifications and standards followed. Here is the list:

Last but not least, Onfido has a 1-year data retention policy that requires it to destroy the customer’s facial recognition data permanently upon the company’s request after one year since the last interaction of the customer with Onfido.

It is important to note that the above testing metrics and analysis is a practical approach through which a KYC Solution can know its actual practical implementation capabilities and success rate. Since KYC AML is a customer-centric industry, the end-decision lies in the hands of a customer. Therefore, seamless User Journey, Minimum FAR, and FRR, scalability, and integration are the core aspects of any solution. We at KYC AML Guide keep these aspects at the heart of our research.

Why are these Stats Important?

The above-mentioned analysis of Onfido merely scratches the surface of the comprehensive knowledge and expertise offered by KYC AML Guide. We are capable of guiding fintech firms and ensuring them high value of their huge investments in KYC Vendors through informed decision-making.

What May be the Impact of Onfido’s Acquisition by Entrust on the IDV Industry?

Both Entrust and Onfido foresee great things ahead. Acquisition of Onfido can enhance the current state of Entrust in Identity Verification keeping in mind that the decision is backed by a robust comparative analysis and that their KYC Solution sufficiently addresses the raised concerns. It is also important to note that this acquisition has not happened as of yet.

It is just the beginning of a newer and brighter future for both companies where Entrust is interested in the AI-based Identity Verification solution of Onfido for countering the threat of Deepfakes and Synthetic Identity Fraud whereas Onfido can enjoy a globally established infrastructure of Entrust. Once the acquisition is complete, both firms can lead the AI-based IDV market and expand their operations further with increased clientele.

Explore Vendor Analysis for a detailed comparative analysis of top-performing KYC Solutions in the world.