Payrow Revolutionises Financial Services for Businesses with Complex Ownership Structures

January 23, 2024

British FinTech Payrow announces the launch of financial services specifically designed for businesses with complex ownership structures in the United Kingdom.

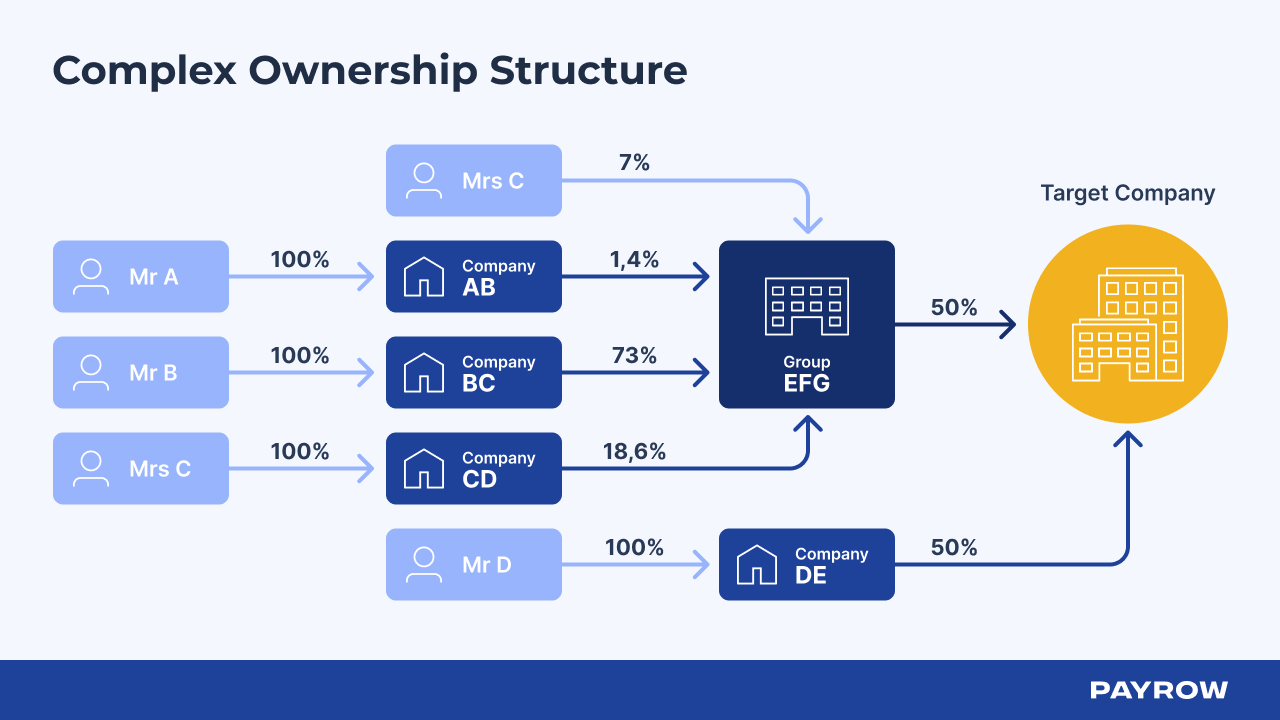

Complex ownership structures are often found within companies with different overseas departments or companies linked together by a chain of ownership. These companies will often have several layers of corporate officers, shareholders, and PSCs (Persons of Significant Control), which makes identifying the owners challenging.

Here is an example of a complex ownership structure:

Despite there being a significant number of companies with complex ownership structures, services that can provide adequate financial assistance for this sector are lacking in the market. The lack of transparency deters many traditional banks and FinTech companies from offering banking services to businesses that fall into this category. Typically, financial services do not have the technical capability to add several owners.

If a bank does agree to work with a company that has a complex structure, opening an account will often mean long waiting periods, submitting a lot of paperwork, and potentially experiencing service problems. Such hurdles often hinder the growth and agility of these businesses.

Responding to a Market Need

Recognising a gap in the market, Payrow has stepped up with a solution that promises to streamline processes for businesses with complex ownership structures. With a team of experts specialising in dealing with such businesses and strong KYC processes, Payrow can efficiently input the required number of owners during business registration and easily offer all the necessary financial services from day one.

At the heart of Payrow’s service is a combination of seasoned expertise and cutting-edge technology. The FinTech’s dedicated team boasts extensive experience in handling large corporate structures, which is complemented by innovative onboarding technology. This dual strategy not only simplifies the identification of ownership but also guarantees a compliant and smooth onboarding experience.

“Business requirements are always changing, and Payrow adapts to these changes. We aim to assist businesses with complex ownership structures, ensuring they don’t have to deal with intricate procedures and extensive paperwork. The combination of an experienced compliance team and advanced technology enables us to onboard these services quickly and comprehensively,” said, Aleksei Glukhov, co-founder of Payrow.

With the FinTech sector rapidly evolving, Payrow’s initiative marks a significant step towards more inclusive financial services. This development not only benefits businesses with complex ownership structures but also strengthens the FinTech industry’s role in facilitating economic growth and innovation.

About Payrow

Payrow is a British FinTech providing financial services tailored to a fast-growing number of entrepreneurs, startups, SMEs, and freelance specialists. The platform offers a wide range of financial services and a convenient, reliable, and affordable ecosystem for its users. Payrow allows you to manage payments with a high level of security, create invoices, and process taxes. Payrow’s uniquely optimized financial flows provide support at every stage of the business cycle.

Featured Solution Provider.

This not an endorsement it is for advertising purposes only.

Socure.

Socure utilizes advanced AI and ML algorithms to analyze a multitude of data points and patterns, aiming to accurately assess the legitimacy and reliability of an individual’s identity. By harnessing diverse data sources like social media profiles, online presence, official records, and other pertinent information, they create a comprehensive and real-time identity verification system.