An Economic Insight

Due to the rise in Financial Crime globally, the current economic situation has fostered improvements in the existing KYC infrastructure. All Types of KYC are now experiencing rapid digitization and a shift towards improved security standards. It is noteworthy that even after an estimated decrease of 2.5% in overall economic growth, firms are becoming more resilient and adaptive to newer ways of ensuring compliance. (State of Financial Crime Survey 2023)

Today, we will focus on the common types of Know Your Customer (KYC), their uses, and how they have been improved through technological advancement.

5 Types of KYC

There are 5 KYC Types that are implemented in different settings and requirements. Following is a detailed and point-wise explanation of these types.

Document-Based KYC

Document-Based KYC or Paper-Based KYC is practiced almost everywhere. It backs up the digital database and is used for verification and cross-referencing of identities. Physical copies of documents are provided for identification and verification. Regulators and Organizations require physical copies of hard-copy records that are accepted by all authorities. These documents can be scanned and the image or pdf is stored in the database. Document KYC requires the following documents:

- Passport (scanned and photocopied)

- ID card (original & copy)

- Driver’s license (scanned and photocopied)

- Tax Statements

- Pay slips

Hence, the regulators verify the information if it is matched, and then your identity is validated through this type of KYC.

Pros & Cons

Although, Document-Based KYC is a thorough process it has its limitations. Storing physical records is costly and requires space. The speed of the verification process in document KYC is a bit slower due to the physical checks and manual handling but it also ensures a high level of accuracy and thoroughness.

Also Read: 5 Issues in KYC Document Verification and Their Solution

Digital KYC (eKYC)

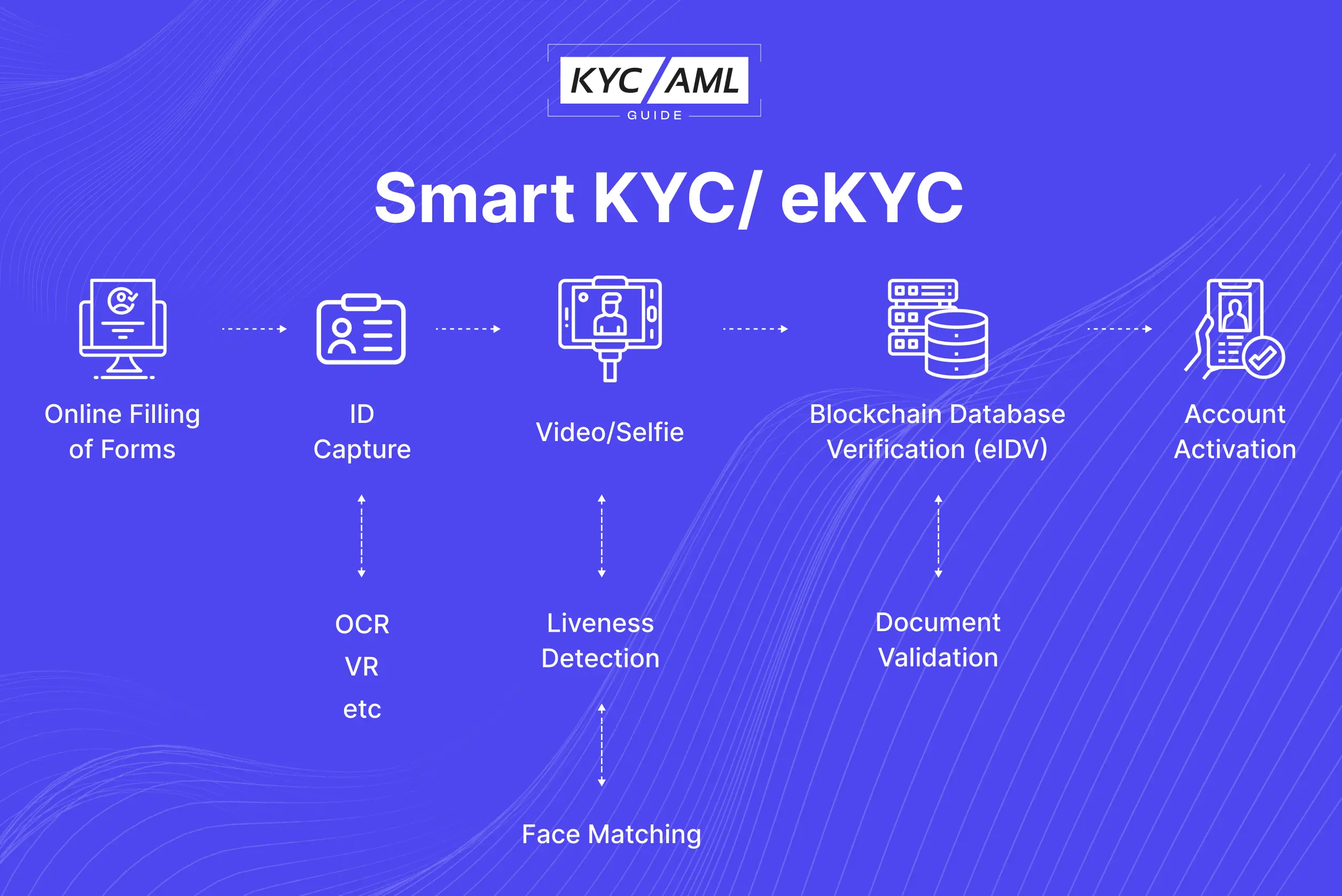

Previously, eKYC was known as Digital KYC which is the paperless way of executing the KYC process. Mostly, electronic records are maintained by bringing in emerging technologies like Blockchain. Since, forging documents, faking IDs, and falsifying physical records are common and easy, eKYC is necessary now. Therefore, to mitigate these threats KYC professionals have designed secure systems as a distinctive type of KYC.

Pros and Cons

Notably, it is a flexible process that allows customers to use Online means of Verification. Particularly, the data identification in eKYC is regularly monitored to make it secure using Artificial Intelligence (AI). But again introducing a newer and more secure technology requires investment. So, users who plan on cost reduction should consider the cost aspect while implementing eKYC.

Normally, Banks and Financial Institutions spend around $30 to $60 million per year on KYC processes.

Video KYC

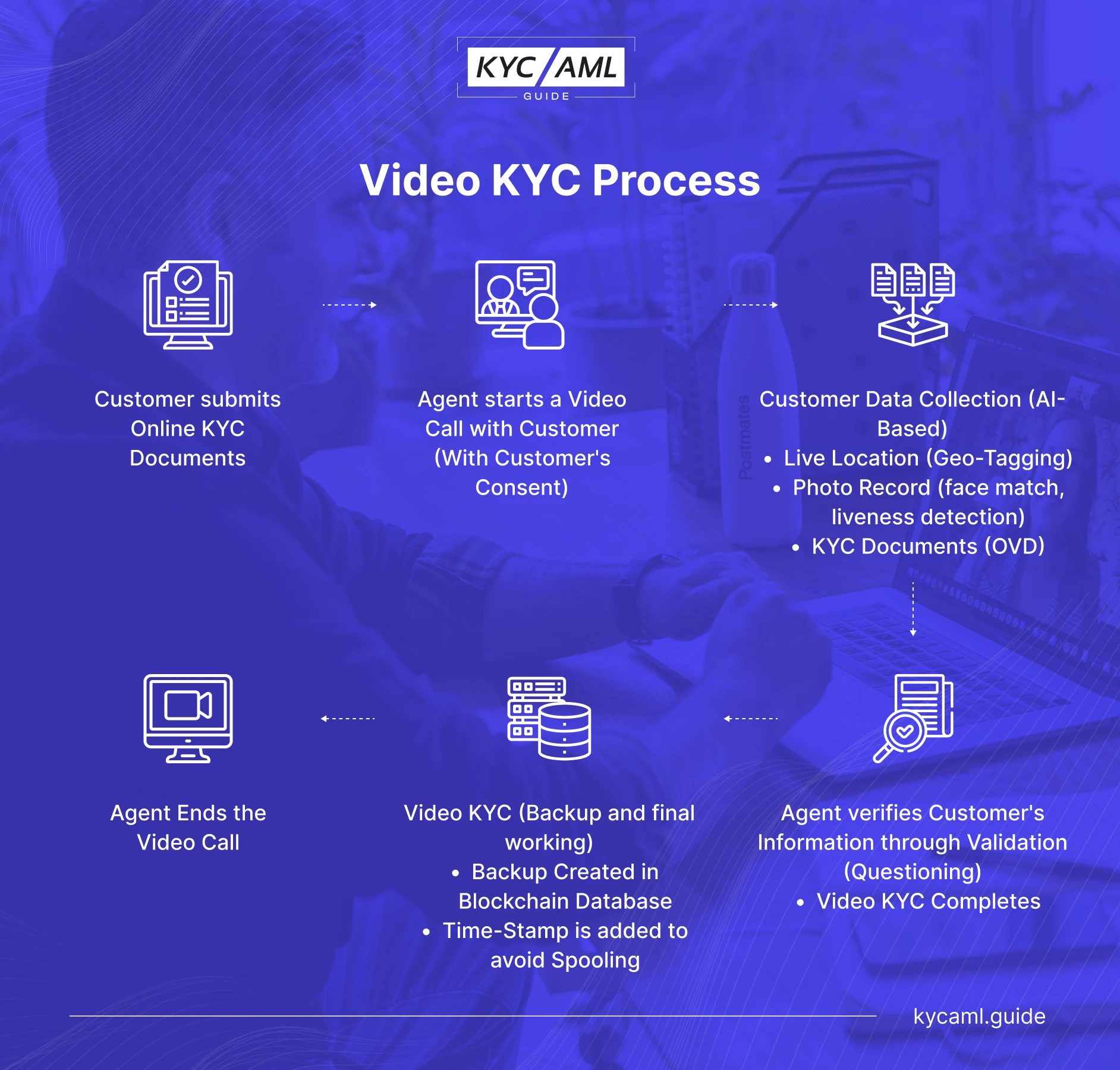

It is a sub-type of Digital KYC. In Video KYC the VCIP (Video-based Customer Identification Process) is used through AI. Facial matches and geotags are used to confirm the customer’s identity via a smartphone application. In this way, customers can remotely have their KYC done.

Also Read: Video KYC: A Game Changer in Remote Identity Verification

Pros and Cons

Mostly, customers now prefer Video KYC as it is an easy way to stay compliant. Being secure and fast it is preferred by firms for seamless onboarding. Despite its benefits, Video Know Your Customer has its drawbacks. Identity theft and Fraud through masking and filters are the main risks involved in Video KYC.

Biometric KYC

One of the most trending and widely embraced technologies is Biometric KYC verification. Firstly, it uses supporting technologies like biometric scanners to record the customer’s data. Also, it has subtypes such as:

- Face Biometric (Facial Recognition)

- Thumb Impression (Fingerprint)

- Palm Scanning

- Retina Eye Scan (IRIS)

- Voice Recognition

Secondly, the recorded data through scanning devices are digitally stored on a blockchain. Thus, the verification team accesses the data and executes the procedure to confirm the identity and do the needful.

Check out the News update: UK Citizen’s Biometrics Council says ICO guidance is a step in the right direction

Pros and Cons

Undoubtedly, Biometric KYC is highly secure and easy to use. Moreover, it is a seamless and latest way of KYC enabling fast and secure customer onboarding. So far, its disadvantages include a high cost, the threat of being hacked, and loss of data.

In-Person KYC

Among the types of KYC, the last one is In-Person KYC or Physical KYC. Distinctively, Physical KYC and Offlines KYC are different from each other. In physical KYC, the customer is supposed to be physically present for true identity verification. In Offline KYC, firms have an offline database of customer identity verification. Here, Biometrics is not used for the IDV. Rather, a PDF cross-referencing file system.

Pros and Cons

Since it is an offline database, it is lower in cost as compared to eKYC. Also, it is simple to use and fast. KYC Regulators are focusing on addressing the limitations of information access & data security. In the jurisdictions of the USA, UK, and Australia, In-Person KYC is now being integrated with the digital KYC for improved performance.

Wrap-up

Each type of KYC serves its unique purpose and offers distinct advantages. The choice among them depends on the specific requirements of the firm and regulatory guidelines. Presently, eKYC and Biometric KYC stand out as the most prominent trends, drawing substantial attention from regulators and firms alike, as they strive for enhanced compliance.

Lastly, Know Your Customer is important for compliance officers and other professionals to efficiently work in achieving compliance-related goals.

Blog articles are available at KYC AML Guide