What is Collusion Fraud?

Collusion Fraud occurs when two or more people, usually employees or business partners, conspire to defraud your organization for financial gain. These criminals operate in the shadows and collaborate to commit various types of financial crimes by leveraging their knowledge and position of trust. Collusive fraud, as opposed to traditional fraud, involves a network of individuals working together, making it difficult to detect and explain.

Assume Sarah, a purchasing manager, works in a large manufacturing plant. Sarah made contact with one of the company’s suppliers, Alex, who offered to submit invoices for the products supplied. In exchange, Sarah ensures that more orders are placed in the hands of Alex’s company, taking a percentage of the lost money. This contract between an employer and a third party is a prime example of a deceptive scheme that can result in massive financial losses.

According to the Association of Certified Fraud Examiners (ACFE) 2022 Report, the median loss in schemes involving a single perpetrator is $57,000. When two or more people collaborate in fraudulent activities, the median loss skyrockets to $145,000. Furthermore, when three or more criminals conspire, the median loss skyrockets to $219,000.

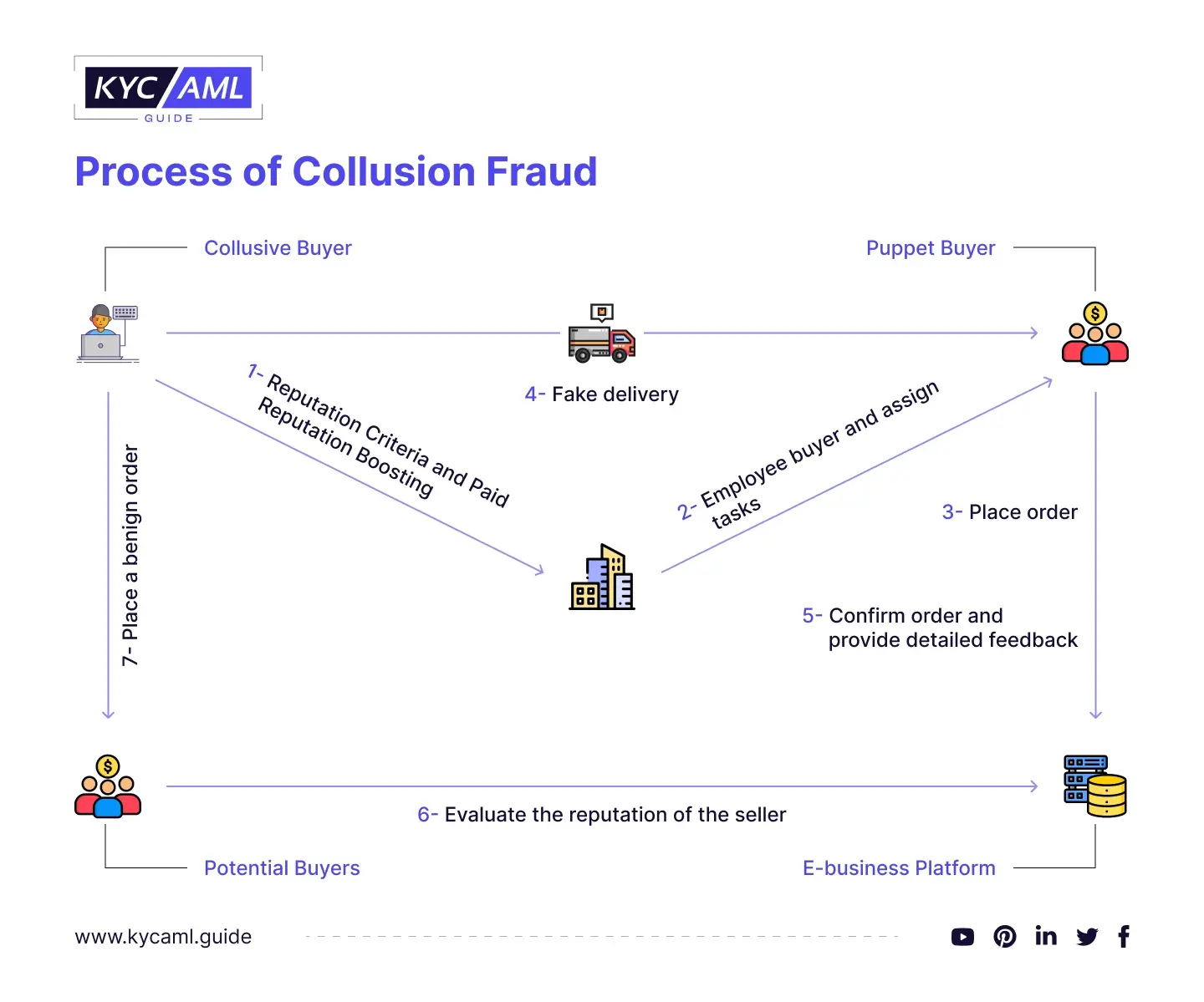

Collusion Fraud in Online Marketplaces

Online marketplaces provide a breeding ground for collusion fraud. Fraud happens when two parties, in this case, the buyer and seller, conspire to commit money laundering or embezzlement, or theft. Each year, eCommerce companies are estimated to lose $48 billion to fraud.

Money laundering occurs when a fraudulent seller posts a false product or service on a marketplace platform, which the fraudulent buyer obtains in exchange for illegal or “dirty” money. Following the completion of the transaction, the seller withdraws the proceeds, effectively “cleaning” the money for legal use.

Collusion Fraud in Bid Rigging

Bid rigging or collusive tendering occurs when businesses that would normally compete secretly conspire to raise prices or reduce the quality of goods or services for purchasers who wish to acquire products or services through a bidding process

For instance, as part of the local government process, the three leaders of a construction company formed a secret alliance. They banded together to restructure the bidding process for major municipal contracts. Even though the nature of the fair bidding process was preserved, one company emerged as the winner as a result of this agreement. This enabled the chosen company to win the contract and ultimately share profits with its sponsors.

Collusion Fraud in Insurance

Insurance fraud collusion occurs when policyholders, service providers, and sometimes even insurance company employees conspire to submit false or inflated insurance claims. This can include faking accidents, staging events, or submitting excessive medical bills. The global market for insurance fraud detection is expected to grow from $5.2 billion in 2022 to $6.4 billion in 2023.

Let’s say a group of four people devised an insurance fraud scheme by staging a car accident to defraud the insurance company. The accident involved several vehicles, but there was no serious damage or injury. They conspired to file false insurance claims, exaggerating injuries, vehicle damage, and medical expenses. The insurance company unwittingly approved these false claims, resulting in large payouts to the fraudsters.

Credit Card Collusion Fraud

Credit card fraud is another form of collusion fraud. Payment card fraud losses are expected to reach $49 billion by 2030, and they are increasing rapidly year after year.

Consider a fraudulent scenario in which a dishonest merchant, “A,” works with an unsuspecting customer, “B.” A runs an online store and accepts B’s stolen credit card information for purchases. In this elaborate ruse, “B”, often enticed by financial rewards, uses stolen card information to conduct high-value transactions. “A” processes these transactions quickly before they are flagged as fraudulent. They split the ill-gotten gains, leaving the credit card holder to deal with the fallout.

Detecting and Preventing Collusion Fraud

The Association of Certified Fraud Examiners (ACFE) discovered in its Report to the Nations 2022 that 6 out of 10 fraud cases, or approximately 58%, were committed through collusion.

Division of Duties:

Ensure that your organization has a clear division of duties. No one should have the authority to initiate, support, or carry out financial transactions.

Monitor Workplace Dynamics:

Keep an eye on the dynamics of the workplace. For example, if a non-accounting team member spends an unusual amount of private time behind closed doors with an accounting colleague, this could indicate potential collusion. Examine any overly familiar connections between employees and vendors as well. Cross-reference their personal information, such as addresses, with that of your employees during vendor vetting to identify any matches.

Monitor Electronic Communication:

Work with your legal team to establish the necessary authority to monitor employee communications, such as emails and instant messages sent over your network.

Regular Review:

Conduct regular financial reviews and audits to identify any discrepancies or unusual events as soon as possible.

Training:

Educate employees about the dangers of collusion fraud and provide training on how to recognize red flags and report them.

Implement KYC/AML Measures:

Perform due diligence on suppliers, partners, and other external sources. It is important to build trust, but trust must always be earned. Identifies all parties involved accurately, making it difficult for individuals to conceal their true identity during the contract. Examines financial transaction monitoring for unusual patterns that could indicate a merger or acquisition.

Data Analytics:

Use AI-powered algorithms to continuously monitor and analyze transactions, communication patterns, and employee relationships, identifying unusual or suspicious behavior that could indicate collusion fraud. Implement real-time alerts and automated reporting to respond to potential threats quickly and prevent future collusion schemes. Combine artificial intelligence (AI) with robust Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols to improve fraud prevention across multiple industries.

Case Study

This report is published by GOV.UK. This case study is a stark reminder of the dangers of collusion fraud in supplier relationships.

Collusion between a contractor’s Contract Manager and the council’s Principal Engineer resulted in a widespread fraud scheme within the Council’s road resurfacing program. The conspirators engaged in various fraudulent activities over a two-and-a-half-year period, resulting in significant financial losses totaling £1.9 million for the council.

The contractor discovered the fraudulent activities of inflating surface areas, exaggerating job duration, falsely claiming the amount of lineage to be painted, and submitting false claims for the disposal of old surfaces. the council for resurfacing work. An external investigation uncovered irregularities such as funds being diverted for personal use, such as work on the Principal Engineer’s house and expenses associated with a boat club where the Principal Engineer married.

Following this discovery, the council launched a thorough investigation into all road resurfacing jobs, revealing the extent of the fraud. The majority of the funds appeared to have been misappropriated through the use of “ghost” subcontractors and false claims for work not performed.

Conclusion

Ultimately, vigilance is essential for detecting and preventing collusion fraud in modern businesses. Organizations can fortify their defenses against this insidious threat by closely monitoring employee relationships, monitoring electronic communications, and leveraging AI-powered tools. Remember to use these observations the next time you work with these parties to protect your assets from the costly consequences of collusion fraud. Stay on guard and safe.