Recently, FinCEN issued a Notice of Proposed Rulemaking (NPRM) that classifies International CVC Mixing as a primary money laundering concern. Let’s look into the Convertible Virtual Currency (CVC) Mixing, its mechanism, and the regulatory framework that governs it.

What is CVC?

IRS defines Convertible Virtual Currency (CVC) as a digital asset that is equivalent in value to a real currency. It is also known as a digital substitute for fiat currency. For example, cryptocurrencies like Bitcoin and Ethereum are renowned CVCs that are used globally. CVC normally refers to all types of digital currencies which are:

- Digital Assets

- Virtual Assets

- Digital Currency

- Crypto Currency

- Crypto Assets

When all these digital assets become convertible through multiple trading platforms, CVC’s definition applies to all of them.

What is a CVC Mixer?

CVC Mixers is a digital platform that offers a secure haven for cryptocurrency transactions. Simply CVC mixers blend cryptocurrency or earnings from other convertible virtual assets with traditional currency, creating a complex web that shields the true ownership and origin of crypto transactions from being detected.

Why do CVC Users Opt for CVC Mixers?

CVC users often seek a CVC mixer for multiple reasons. According to FinCEN, not all CVC traders are using mixers for illegal activities. However, since it offers anonymity it can shield illicit activities and undermine the legitimate uses of CVC Mixers.

Here are a few reasons why CVC owners utilize the services of a CVC Mixer.

| Enhanced Privacy | CVC Mixers allow users to increase the privacy of their transactions. It is challenging to trace the origins and destinations of funds by using CVC mixers. |

| Security | CVC users prefer mixers for the prevention of threats of fraud, hacking, and scams. |

| Decentralization | Decentralized mixers operate without a central authority, which can appeal to users who prefer a peer-to-peer and trustless approach to mixing their assets. |

| Avoiding Tainted Coins | CVC mixers can help users avoid receiving tainted or blacklisted coins that may have a negative history or connection to illegal activities. |

| Minimizing the Risk of Tracking | Third parties often track financial information via crypto transactions and may use this information for promotional or marketing objectives. CVC users opt for mixers to avoid unwanted marketing messages and promotional offers. |

Apart from the legitimate reasons for using CVC Mixers or Tumblers, here are a few questionable reasons why CVC users prefer Mixers:

- Avoid surveillance by government agencies and law enforcement when the earnings are generated from illegal sources like hacking, theft, etc.

- Concealment of ownership information and Obfuscation of transaction trails for Money Laundering.

- Financing criminal activities and other crimes.

In May 2022, the US Department of Treasury sanctioned the cryptocurrency mixer “Blender.io” due to being involved with the North Korean cyber-terrorist group Lazarus APT. According to the sources, $625 million worth of Ethereum was stolen from the Ronin network.

How does the CVC Mixer work?

Publicly, Virtual Currency transactions are transparent and immutable on a blockchain ledger. They cannot be changed but if a crypto asset owner wants a high level of privacy and security of transactional information, certain techniques can conceal this information.

Here are the main steps through which a CVC Mixer or a Crypto Tumbler performs the mixing process:

- Input Collection: Users send their cryptocurrency to the CVC mixer, providing virtual assets from various sources or owners.

- Decentralized or Centralized Mixer: The mixer can be either centralized or decentralized. In a centralized mixer, a third-party or trustless network controls the mixing process, while in a decentralized mixer, the process occurs without a central authority.

- Funds Mixing: The mixer’s primary function is to mix or blend the virtual assets from different sources. It achieves this by commingling the incoming cryptocurrencies, making it challenging to trace the original ownership.

- Destination Nodes: Once the funds are mixed, they are sent to the destination or receiving nodes. These nodes can be owned by the same users or other users in the network.

- Anonymity: The key feature of the mixer is that the funds transferred to the destination nodes lack information tokens that are attached to the actual ownership. Additionally, there is no information about the sources of the funds, making it challenging to trace the transaction’s origin.

- Varied Entry Points: CVCs enter the ledger from different nodes, ensuring that the mixing process is effective. This variety of entry points further obfuscates the transaction trail.

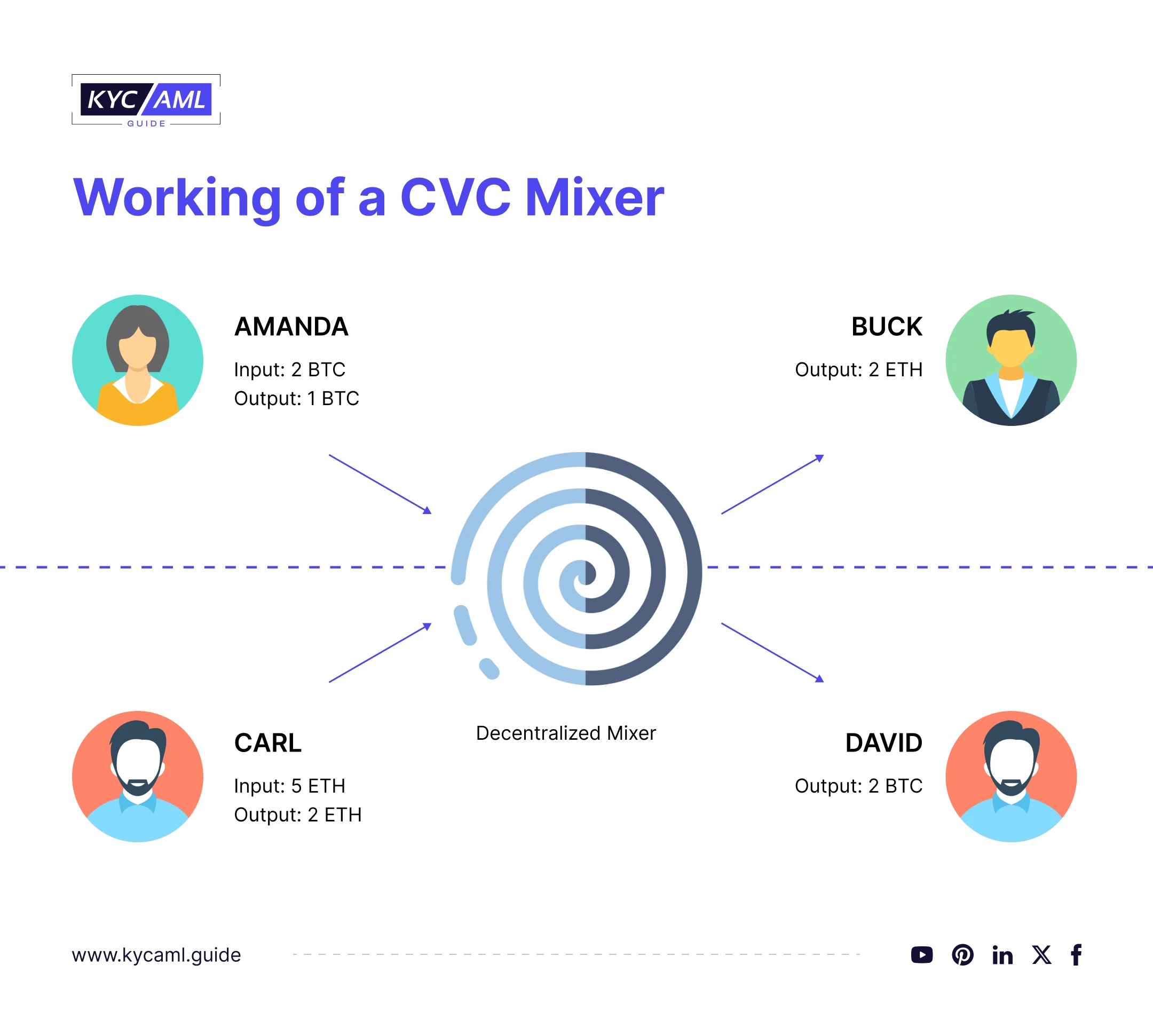

To simplify the process for better understanding, consider the infographic and its explanation as shown below:

Scenario:

Scenario:

Amanda and Carl wish to enhance their privacy in crypto trading and they both selected a CVC Mixer. Amanda has 2 Bitcoins (BTC) and Carl has 5 Ethereum (ETH). Buck and David want to purchase Crypto and chose the same CVC Mixer for the same reason i.e. enhanced privacy. Buck requires 2 ETH and David wants 2 BTC.

Step-1:

- Amanda sent 2 BTC to the CVC Mixer and Carl sent his 5 ETH to the same Mixer.

Step-2:

- CVC Mixer combines/mixes both Amanda’s BTC and Carl’s ETH with thousands of others in its blockchain. It shuffles the transactions making it difficult to trace the input transaction of Amanda and Carl.

Step-3:

- CVC Mixer sends 2 ETH to Buck and 2 BTC to David from mixed cryptos.

Step-4:

- It sends 1 BTC to Amanda and 2 ETH to Carl upon request. But these crypto are different from both their initial input BTC and ETH.

It is important to note that Carl who has 5 ETH has cashed out 2 ETH upon his requirement, and Buck anonymously received 2 ETH of Carl. Now Carl has 1 ETH left in CVC Mixer which he can cash out when he wants. But he will not receive the same ETH as his 5 ETHs are already mixed and shuffled. The point is that nobody except CVC Mixer knows of the transaction trails from both input and output ends.

According to FinCEN, CVC Mixing is not completely done through mixers. It involved other techniques as well. Some of them are listed in the NRMP and mentioned below:

- Combining CVCs from one or more accounts or wallets, smart contracts or accounts, obfuscating their identity of transaction and shielding the unique identifiers of both parties.

- Splitting a single CVC transaction into multiple small untraceable amounts, blending them with other split transactions, and sending them to multiple users or in multiple smaller transactions to the single receiver. It is very similar to structuring in money laundering.

- Using software or algorithms carry out CVC mixing.

- Using peel-chain (Single-use wallets) in a series of unnatural transactions that have the purpose or effect of obfuscating the source and destination of funds.

- Exchanging between multiple types of CVC involving Cryptocurrencies and other digital assets to layer different types of CVCs.

- Using pre-programmed time-delay of transactions to appear

CVC Mixing & Money Laundering

Convertible Virtual Currency Mixing or Virtual asset transfers can be used for legitimate and & Innovative purposes. However, the risk of money laundering and other financial crimes due to the high level of anonymity is there. Multiple crypto assets are traded and transactions are occurring daily globally.

- According to Bitcoin, in 2022 an average of 255,086 crypto transactions were occurring per day. In 2023, the number hiked to 378,833.

This shows the potential of thousands of transaction trails, identities, and ownerships involved in digital asset transactions.

Impact of Regulatory Updates on CVC Mixers

So far, the CVC Mixers have been operating as non-regulated entities and provided services to crypto asset service providers (CASPs) or Virtual Asset Service Providers (VASPs). However, after FinCEN’s Notice of Proposed Rule Making (NPRM), the CVC Mixers are now under the Anti-Money Laundering radar of the US’s regulatory framework.

Read the News post here

The proposed rule-making will help regulate virtual asset transfers and there is a high possibility that CVC Mixers may be required to retain and share a certain level of information to track the rogue state actors that are using the system for laundering illicit money. Moreover, the immutable nature of Convertible Virtual Assets can be retained but disclosing information if a suspicious transaction is detected might likely be asked by CVC Mixing service providers.

The Role of KYC AML Solutions in Preventing CVC Mixer-Based Money Laundering

Firstly, the KYC and AML Solution providers have a prime focus on identity verification and authentication. They operate by being connected to billions of identities to increase the scrutiny level so that they can offer high levels of accuracy in identifying and detecting suspicious transactions and activities. With the implementation of a robust KYC and AML solution, the threat of CVC Mixer-based money laundering can be mitigated. However, it needs to be considered that a third-party solution provider having access to identities and transaction information whether through a decentralized or centralized ledger can still compromise the element of privacy. However, with the proper guidelines on data privacy and consent, the KYC and AML solution providers can offer a great deal to prevent financial crimes through digital assets, especially through CVC mixers.

Explore how KYC AML Guide can help you choose the right Identity solution through KYC Technology Buying Consultancy.

Final Thoughts

FinCEN Director Andrea Gacki stated in the NRMP:

“CVC mixing plays a vital role by enabling various actors within the realm of ransomware, rogue state elements, and criminal networks to finance their illicit pursuits while concealing the trace of ill-gotten proceeds. It marks a significant step as FinCEN utilizes the Section 311 authority for the first time to address a category of transactions associated with primary money laundering risks. In alignment with our ongoing endeavors in the conventional financial sector, the Treasury is committed to actively identifying and eradicating the illicit exploitation and misuse of the CVC ecosystem.”

Therefore, Convertible Virtual Currency (CVC) Mixing service providers, VASPs, and other currency platforms need to stay updated embrace the importance of AML regulations and contribute to the fight against money laundering. For this purpose, they can employ KYC solutions for ID verification to ensure authentic and genuine customers are onboarded. This will help prevent criminals from using the financial ecosystem via CVC or any other mode of payment.