What is Cryptocurrency?

The digital world’s rapid evolution has transformed traditional industries while also spawning new businesses and technologies. Among them, Blockchain technology has emerged as a game changer, allowing for more efficient and cost-effective business operations.

The concept of a decentralized network, best known in cryptocurrencies such as Bitcoin, Litecoin, and Ethereum, is at the heart of Blockchain. Bitcoin, which was introduced in 2009 by an anonymous programmer or group known as Satoshi Nakamoto, transformed the financial landscape by providing a peer-to-peer electronic money system that did not require central control.

The increasing number of cryptocurrencies has piqued the interest of governments and regulators all over the world. Although cryptocurrencies are becoming more popular, their lack of transparency and anonymity, and challenges of regulating crypto have raised concerns. Authorities are concerned that it could be used for illegal purposes such as money laundering, terrorist financing, and tax evasion.

Scams involving cryptocurrency increased in 2022. According to Chainalysis, bad actors stole $3.1 billion in 2022, with DeFi protocols accounting for 82.1% of the stolen cryptocurrency. Some countries have outright banned cryptocurrencies, while others, such as Japan and Sweden, have chosen to regulate their use through legal means.

What is Crypto Regulation?

The creation and enforcement of laws and regulations governing the use, trading, and issuance of cryptocurrencies is the primary goal of cryptocurrency regulation, with the primary goal of bringing stability, security, and fairness to the cryptocurrency market.

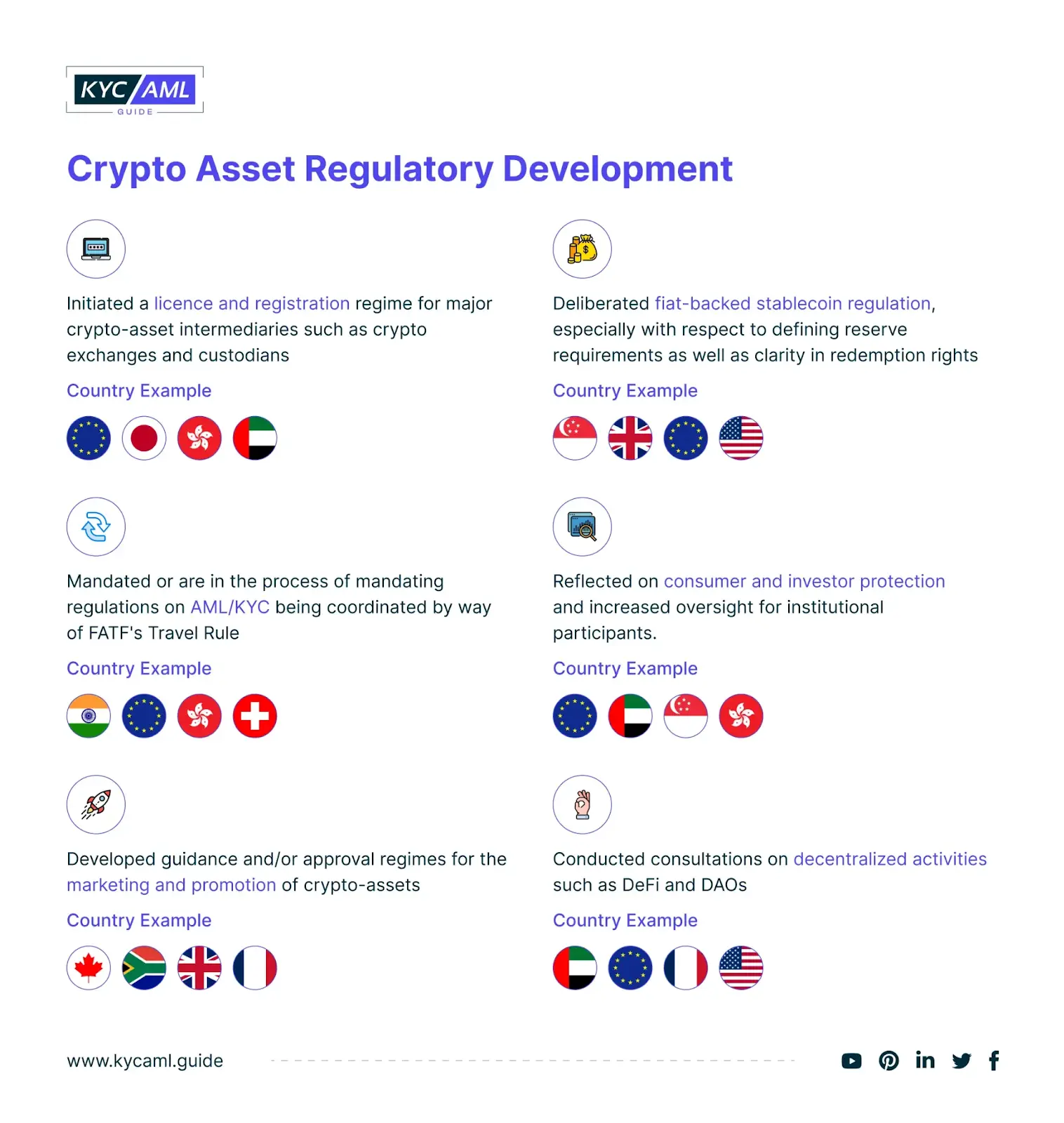

Governments and regulatory agencies all over the world have enacted various types of cryptographic laws. These measures could include obtaining licenses for cryptocurrency exchanges, implementing anti-money laundering (AML) and know-your-customer (KYC) procedures, building tax systems, and instituting safeguards for investors in the space.

Cryptocurrency regulation in the United States is a dynamic and evolving landscape, with both regulators and the general public showing increasing interest. The CFTC classified Bitcoin and Ethereum as commodities, subjecting exchanges trading these assets to CFTC oversight, and the SEC ruled that ICOs are securities, subjecting them to traditional securities regulations. Other laws and regulations, such as anti-money laundering, anti-kickback, and tax laws, may also apply to cryptocurrencies. More regulations are expected to be implemented in the future as the industry grows and regulators gain a better understanding.

The Markets in Crypto-Assets (MiCA) Regulation is a crypto bill that aims to improve consumer protection and licensing standards across the European Union by establishing a unified regulatory framework for the entire bloc.

Cryptocurrency and the Current Challenges Facing the Market:

Cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOGE) have recently seen a surge in popularity, attracting a diverse group of investors ranging from Wall Street professionals to everyday people. However, because of its decentralized nature and lack of oversight, there have been concerns about consumer protection, market manipulation, and money laundering. While some advocates stand for a more hands-off approach to encouraging innovation, others argue that adequate laws are required to protect investors from fraud and market vulnerability.

Regulators face numerous challenges in regulating crypto and in striking a balance between encouraging innovation and protecting the interests of investors.

- Defining cryptocurrencies and classifying them within the existing legal framework is a difficult task. The distinct nature of digital money calls into question the definition of traditional money, necessitating changes or the establishment of entirely new legal systems.

- Ensuring compliance and combating malicious activity in the cryptocurrency industry is a significant challenge. Because of the anonymity associated with digital currency, there are concerns about its potential misuse, such as money laundering or supporting illegal activities.

- Furthermore, due to the global nature of the cryptocurrency industry, regulatory challenges cross national borders. As digital currencies operate in multiple countries and jurisdictions, international standardization becomes critical to avoid legal arbitrariness and to ensure that investor protection standards are consistent.

- In many countries, consumer protection laws for crypto markets are lacking, putting investors at risk of theft, fraud, and misleading advertising. Only one-third of the countries studied have specific consumer protection laws, and the existing laws in some cases are untested or unclear. Countries such as India, France, and South Korea, on the other hand, have taken steps to protect consumers and improve transparency in cryptocurrency investments. Some counties have a status of regulation in taxation, AML/CFT, licensing, and consumer protection.

- In comparison to developed economies, low- and middle-income countries are slow to adopt cryptographic standards. While 64% of advanced economies have laws governing taxation, anti-money laundering, consumer protection, and licensing, only 11% of middle-income countries have all four, and low-income countries have none.

In this case, regulators must collaborate to develop a common approach that promotes innovation while also closing regulatory gaps that can support new services. Some countries are regulating crypto such as

As Hong Kong has taken a favorable stance towards cryptocurrencies. The city-state issued a policy statement last year allowing retail investors to trade in cryptocurrencies. Following the publication of a consultation paper, the government implemented a new crypto regulatory framework, allowing retail investors to trade virtual assets, and the Securities and Futures Commission (SFC) will issue licenses to crypto exchanges.

Singapore is known for its welcoming attitude towards digital assets, but following the recent market meltdown, it has become more cautious in regulating the crypto industry. The Singapore Monetary Authority (MAS) has hinted at tightening stablecoin regulations and has asked crypto-related companies to conduct more rigorous customer due diligence.

Also Read: What is the Crypto Travel Rule & How Does It Help in Combatting Money Laundering

Cryptocurrency Regulation: Legal Issues and Challenges:

The Contractual Issue:

The use of self-executing smart contracts and blockchain technology raises the level of uncertainty in traditional contractual relationships. In explicit federal legislation, the legal validity of permanent smart contracts is uncertain, potentially leading to lawsuits.

Jurisdictional Challenges in Cross-Border Transactions

The decentralized nature of blockchain makes it difficult to determine the rights and laws that apply to cross-border transactions. Due to the technology’s global limitations, law enforcement among blockchain users is another challenge.

Data Theft and Financial Fraud

The anonymity of cryptocurrencies can entice users to engage in illegal activity, resulting in data breaches and financial fraud. Existing data protection laws may struggle to deal with theft stemming from blockchain transactions.

Implications for Taxpayers

For US federal income tax purposes, cryptocurrencies are classified as proprietary rather than currency. Donors must report transactions in US dollars and pay capital gains taxes on profits, which necessitates complex redress procedures.

Concerns about Intellectual Property

The use of cryptocurrencies in the IP-intensive sector raises concerns about ownership, distribution, and smart contract implementation of IP contracts. Blockchain technology ownership is uncertain.

Investors’ Legal and Regulatory Concerns

Investors face risks due to the lack of challenges in regulating crypto. In the case of complications, investors may have limited legal recourse for applicants.

As,

China has imposed stringent regulations to limit speculation and maintain control over its financial sector. Initial coin offerings (ICOs) are now subject to stringent regulations, and cryptocurrency exchanges are no longer permitted to operate in the country.

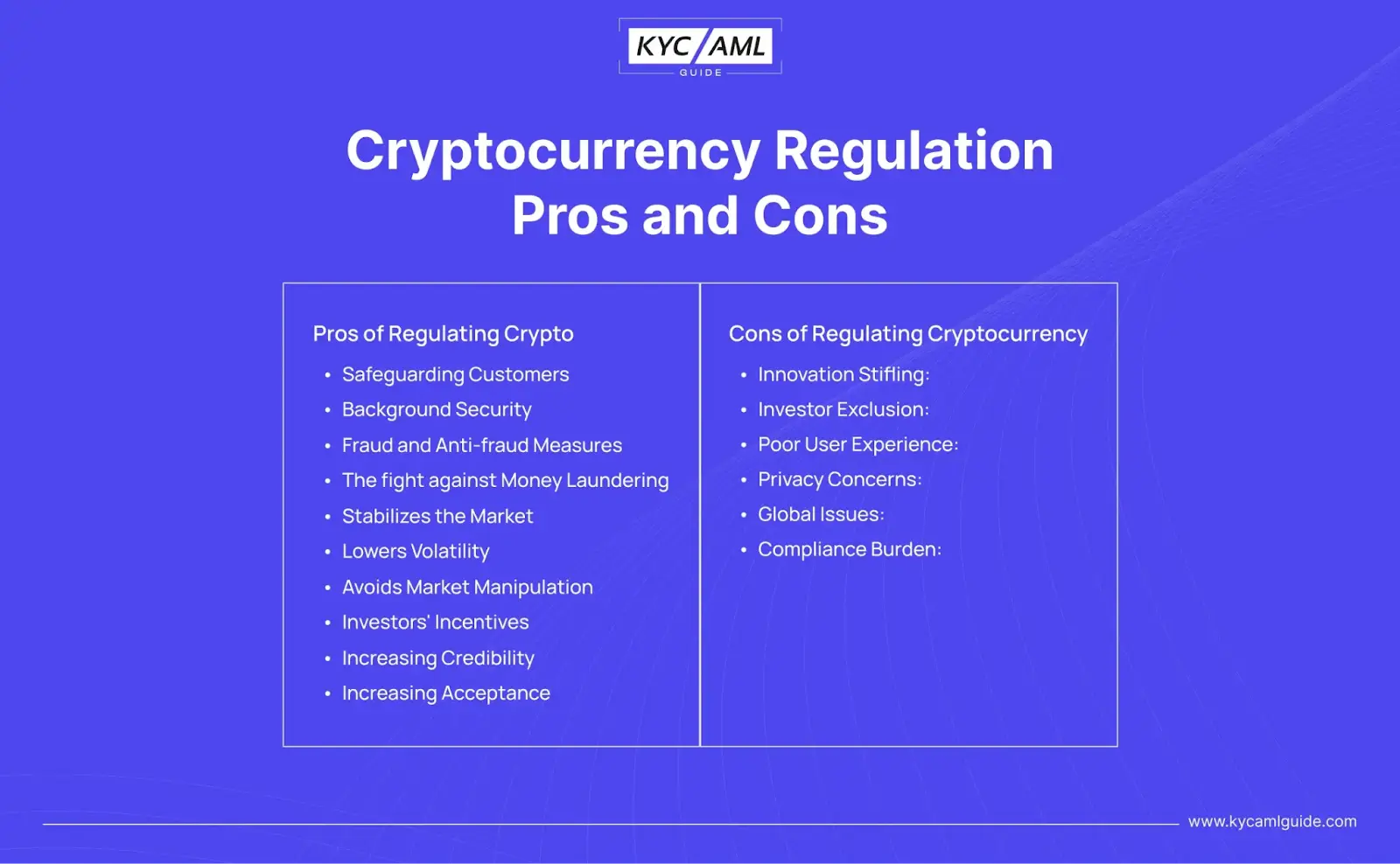

Cryptocurrency Regulation Pros and Cons

Since there are numerous challenges in regulating crypto, it has several pros and cons.

Pros of Regulating Crypto

Safeguarding Customers

Consumer protection is one of the primary benefits of cryptocurrency regulation. Cryptocurrency market regulations protect individuals who use cryptocurrencies.

Background Security

Users’ money is protected from thieves and theft by legal measures such as mandatory security regulations and inspections for cryptocurrency exchanges. Strong security practices assist in lowering the risks associated with cryptocurrency transactions.

Fraud and Anti-fraud Measures

Laws are critical in preventing fraud and fraudulent activity in the cryptocurrency space. Authorities can monitor and investigate suspicious activity, lowering the likelihood of people falling victim to fraudulent schemes.

The fight against Money Laundering

Crypto laws aid in the fight against money laundering, as well as terrorist financing. Authorities can track and detect suspicious transactions using anti-money laundering (AML) and know-your-customer (KYC) procedures, reducing the illegal use of cryptocurrencies.

Stabilizes the Market

Crypto regulation helps to stabilize the market by increasing the confidence of new investors and attracting company participation.

Lowers Volatility

Volatility is a well-known feature of the cryptocurrency market, causing traders to suffer massive losses. Regulatory systems can help reduce volatility by implementing cost-cutting measures.

Avoids Market Manipulation

This law aims to protect the market from fraudulent practices such as redemption and dumping schemes and insider trading. Regulators create a level playing field for all participants by enforcing transparency and accountability.

Investors’ Incentives

To fully participate in the market, institutional investors frequently require regulatory oversight and control. Clear rules encourage investors and businesses to enter the cryptocurrency space, growing its size and development.

Increasing Credibility

Regulation boosts the credibility of cryptocurrencies by requiring transparency and accountability. This increased trust among users, investors, and the general public strengthens the reputation of cryptocurrencies as a legitimate financial asset.

Increasing Acceptance

When cryptocurrencies follow regulatory guidelines, they are more likely to be accepted by established financial institutions and businesses. Increased acceptance makes it easier to use cryptocurrencies in everyday transactions, which aids in their widespread adoption.

Cons of Regulating Cryptocurrency

Innovation Stifling:

Excessive regulation can suffocate innovation in the crypto assets industry, potentially impeding the sector’s growth. To enable small businesses to raise funds from a variety of investors, the right balance of regulation and innovation must be struck.

Investor Exclusion:

Because tokens are classified as private securities, the investor pool is limited to accredited investors, limiting opportunities for non-accredited individuals and potentially exacerbating wealth inequality. The accreditation standard is intended to protect investors, but a more thorough assessment of financial acumen could bridge the gap.

Poor User Experience:

Due to increased customer identification procedures for KYC/AML compliance, the user experience in purchasing or trading tokens has become more complicated. While this may cause inconvenience for regular users, the goal of these measures is to combat criminal activity associated with cryptocurrencies.

Privacy Concerns:

Strict regulations may jeopardize the privacy and anonymity features that drew users to cryptocurrencies in the first place. Existing data protection laws in the United States do not adequately address the privacy concerns raised by blockchain technology.

Global Issues:

Because cryptocurrencies are global, uniform regulation across borders is difficult, potentially leading to regulatory arbitrage and confusion.

Compliance Burden:

For smaller businesses, compliance with extensive regulations can be costly and burdensome, impeding their ability to enter the market and a challenge in regulating crypto.

Also Read: KYC in Crypto: Why is it Important for Crypto Exchanges?

Future of Crypto Regulation

The future of cryptocurrency is determined by how regulations are developed and implemented. The United States and other jurisdictions are grappling with how to challenges in regulating crypto properly, and the outcomes of ongoing legal battles such as the Coinbase and Binance lawsuits will have a significant impact on the industry.

Although regulating cryptocurrencies as a security can provide stability and oversight, this is a paradox given that cryptocurrencies were created outside of the traditional legal system. Such a decision may limit the options for cryptocurrency services and have an impact on their market viability.

The SEC’s crackdown on Kraken for its unregistered equity trading program is an example of a violation. The payment of $ 30 million and the program’s termination demonstrate the seriousness of the illegal cryptocurrency exchange system.

In general, the future of cryptocurrency will be shaped largely by resolving the challenges in regulating crypto and establishing clear principles for the operation and growth of cryptocurrency.