Cryptocurrency Crime Insights

Research shows that in 2021, a sum of illegal cryptocurrency transactions was found to be $14 Billion. In 2022, it was found that almost $10 Billion in cryptocurrency was held in illicit addresses. Despite this, in 2023 Cryptocurrency crimes dropped by 65% according to Reuters and the National.

With the rise of cryptocurrency theft & fraud, industries are more focused on making companies AML and KYC crypto-compliant to prevent financial fraud. Notably, these firms must determine the anonymous activities associated with cryptocurrency transactions. It takes place by implementing the most recent KYC regulations to know their customer better and in a trustworthy manner.

What is KYC in Crypto?

KYC crypto refers to a set of processes by financial organizations that are implemented to identify customers’ identities in the cryptocurrency ecosystem. The first phase of KYC is due diligence in Anti-Money Laundering and helps these companies recognize any risk associated with the client before onboarding them.

KYC is also required in cryptocurrency exchanges to supplement the implementation of AML regulations. KYC prevents financial crimes such as money laundering by identifying customers’ identities.

Money laundering in crypto refers to the concealing of the sources of money acquired in illicit ways. On the other hand, financial terrorism is the practice of providing financial aid to individuals or organizations involved in terrorism. Both of these acts fall under financial crimes and are considered extremely illegal which can pose a critical threat to global security.

Also Read: Crypto Travel Rule and its Role Against Money Laundering

How Does KYC Crypto Work?

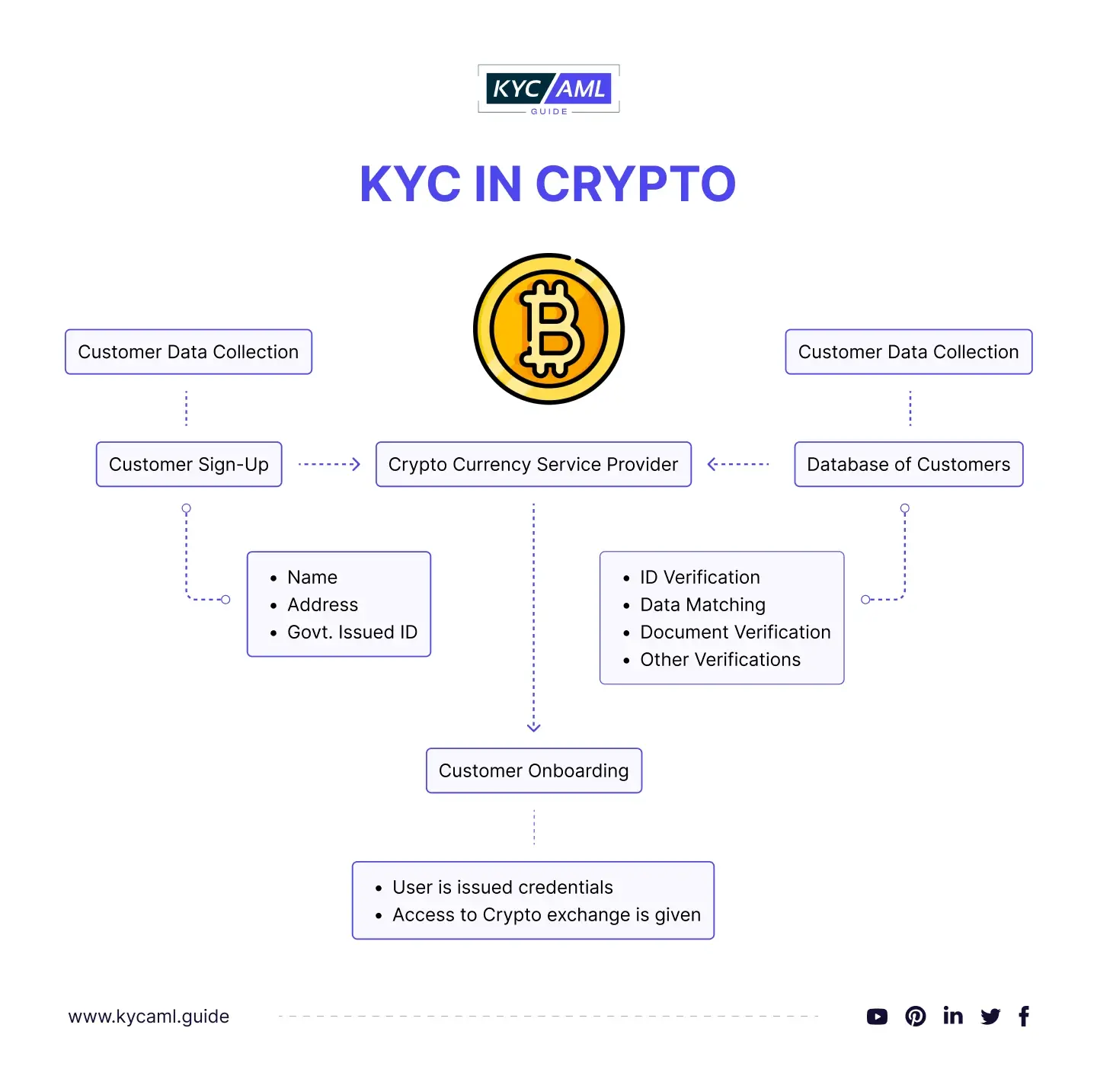

KYC in crypto works the same as it works for other financial institutions. It is a 3-step process explained below.

-

Customer Data Collection

Firstly, when the customer signs up for an account on a cryptocurrency service provider that requires KYC, their data is collected. The client needs to provide personal information including their full name, address, and government-issued identification. This information is utilized to verify the customer.

-

Verification Process

In the verification process, these service providers verify the data and compare it with the database information and other sources to confirm the customer’s identity. This step involves procedures such as checking ID documents against a government database, verifying addresses, and conducting background checks.

-

Customer Onboarding

Once the verification is complete and in case the company is satisfied with the customer, they approve the use of onboarding. And, the user is able to access their services.

Why KYC Crypto is Important?

Many cryptocurrency service providers are now moving towards implementing KYC compliance regulations despite the hurdles they might face during the process. This is because doing this can deliver numerous benefits not only to the organization but to the clients as well. However, KYC in crypto is essential in numerous ways:

| Reduced Fincrimes and Money Laundering |

|

| Better Market Sustainability |

|

| Reputational Damage Control |

|

| Diminished Legal Risks |

|

| Increased Trust Among Users |

|

Read the latest News on KYC Crypto: Bitget updates KYC verification requirements for improved anti-fraud measures.

Bottom Line

Incorporating KYC crypto compliance standards or regulations is essential to prevent the industry from financial crimes such as money laundering. With the rise of technology, cybercriminals are becoming smarter and finding more sophisticated ways to commit crimes. Therefore, when cryptocurrency exchange service providers integrate a robust KYC (Know Your Customer) system, it delivers numerous benefits and makes them secure. To meet financial goals and prevent crimes, KYC compliance has become an indispensable cornerstone of modern business operations primarily in the crypto-realm.