What are the Warning Signs of Money Laundering?

Money Laundering is a complex criminal activity with the sole purpose of hiding the illicit cash and turning it into legal cash through a complex series of undetectable transactions. Money Laundering is carried out in 3 stages namely Layering, Structuring and Integration. Following are the 10 warning signs that indicate Money Laundering activity.

| 1 | Unusual Transactions | Banks and Financial Institutions can raise Red Flags if the transaction patterns of a customer deviate from his or her routine. |

| 2 | Rapid Movement of Funds | Transferring funds at a higher pace without a clear explanation raises the risk of Moneny Laundering activity. |

| 3 | Transactions with High-Risk Jurisdictions | When customers send or receive funds suddenly or frequently to a high-risk country it indicates a serious threat towards money laundering or terrorism funding. |

| 4 | Suspicious Activity or Behavior | Customers who depict a unusual behaviours and try to avoid due diligence are a risk to the financial security. Most likely they are involved in a financial crime if the continue such behavior and try to outwit the system. |

| 5 | Lack of Documentation | Inconsistencies or incomplete documentation may result in raising flags of Money Laundering activity from a customer’s account. |

| 6 | Layering & Structuring of Funds | A high number of transactions in amounts below the threshold indicates a potential money laundering activity. Layering and Structuring activity make the money laundering process complex and difficult to detect. |

| 7 | Transactions through Shell Companies | Companies that lack genuine business purpose or have questionable legal standing are often used for concealment of illicit funds. A shell company acts as a cover for investing illegal money and becomes tool for Money Laundering. |

Importance of Identifying Money Laundering Warning Signs

Recognizing the signs of a threat holds paramount importance in mitigating it well before time. Money Laundering signs require high level of vigilance and proactive approach in threat mitigation and prevention. Red Flags are the indicators of criminal activity and must be identified before time to avoid financial losses, reputational damage to the firm, and the erosion of trust within the financial ecosystem.

Following are the main benefits of early detection of Warning Signs of Money Laundering.

- Enhanced Compliance increases the customer, trust, financial integrity and credibility of the firm.

- Proactive Detection helps in maintaining the security standards and protect genuine customers. Timely detection of money laundering will help in upholding justice against crime at large.

- Early Prevention of Money Laundering saves the hassle of legal battles and proving innocence.

- Collaboration among regulators, law enforcement, firms & financial institutions for the mitigation of Money Laundering threat empowers the society against illicit money and protects the overall economic growth.

Also Read: Money Laundering White Collar Crime

Importance of Reporting the Red Flags For Money Laundering

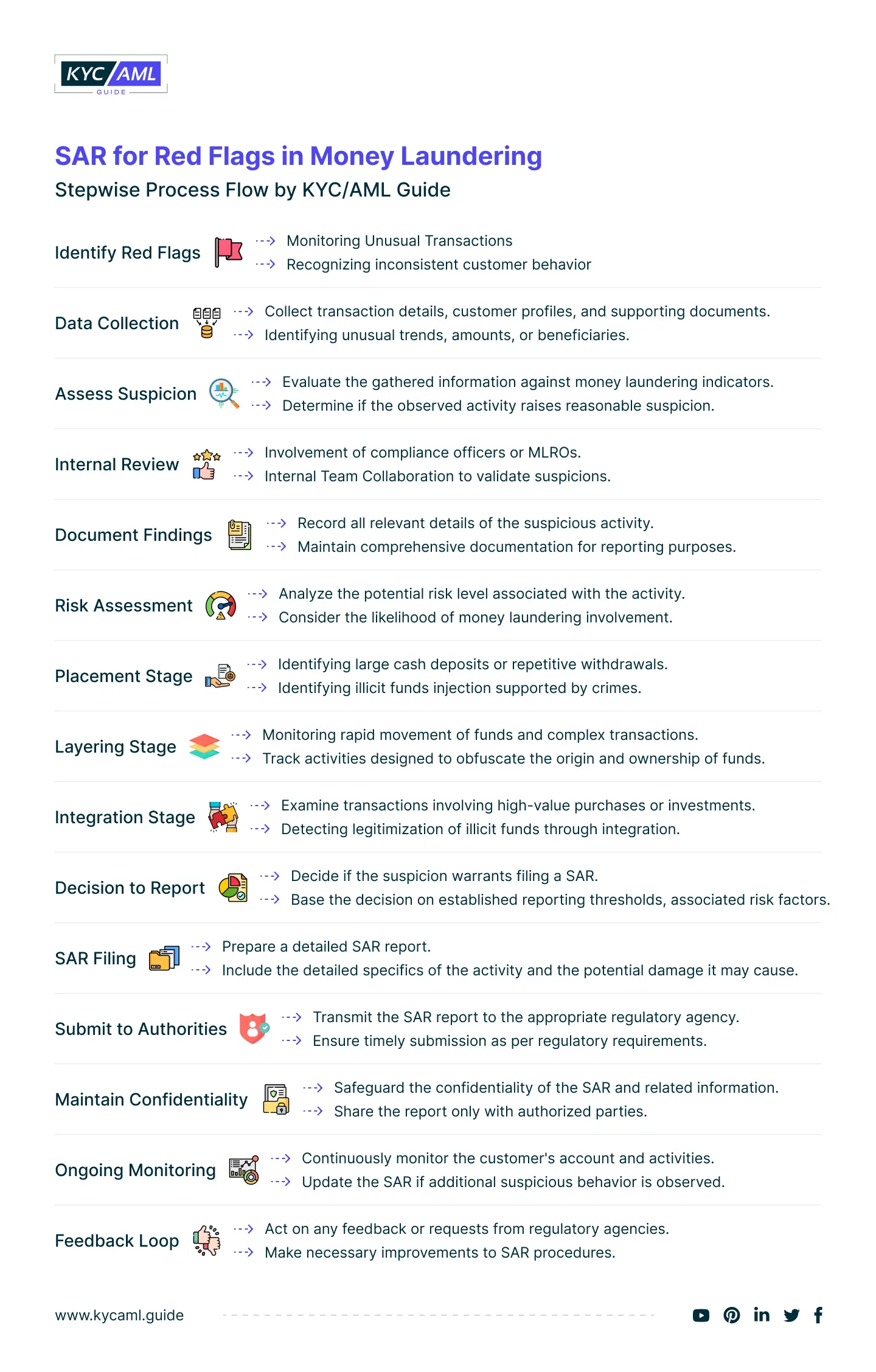

It is vitally important for the firms to report the Money Laundering activity prior to its occurance. Through a stepwise approach, the red flags of Money Laundering can be timely reported and prevented as explained below:

In the above mentioned chart, the Suspicious Activity Reporting (SAR) can play a pivotal role in the prevention of Money Laundering and its stages.

What are Preventive Measures against the Red Flags?

| 1 | Robust Customer Due Diligence (CDD) |

|

| 2 | Anti-Money Laundering (AML) Procedures |

|

| 3 | Risk Assessment |

|

| 4 | Transaction Monitoring |

|

Apart from the above mentioned preventive measures, the implementation of a robust Know Your Customer (KYC) system can play a vital role in preventing the warning signs for Money Laundering. Since, KYC is offered as a compliance service suite with entirety, many service providers are competing their way to make the financial ecosystem safe for everyone. For better insights and enabling informed decision about the world’s leading KYC & AML service providers visit Companies Comparison page of KYC AML Guide.

Bottom Line

Money Laundering poses an ever-rising risk to the financial integrity of banks & financial institutions. It is also a risk to the genuine customer’s trust-based relationships with organizations. So, to prevent it, the warning signs (red flags) must be identified timely and stopped with the implementation of a robust KYC and AML system.

Visit KYC AML Guide for more information