Why Is AML Compliance Necessary For Small Businesses?

In addition to being a legal requirement, compliance with AML legislation is an essential part of responsible and ethical business conduct. Regardless of their size, organizations must prioritize compliance with AML if they are to act ethically, securely, and legally. Small businesses with under 5,000 representatives pile up higher per capita compliance costs than larger businesses as per globalscape. For businesses of all sizes, it is important to comply with AML regulations because:

- Prevent illegal activities including money laundering and terrorist financing.

- Ensure compliance with the law and avoid fines and reputational damage.

- Provides access to financial services and international markets.

- Demonstrate ethical business behavior and social responsibility

- It attracts investment and promotes moral behavior.

- Control the dangers of financial crime.

- Improve security throughout the financial system.

- Protect your company’s credibility and trust.

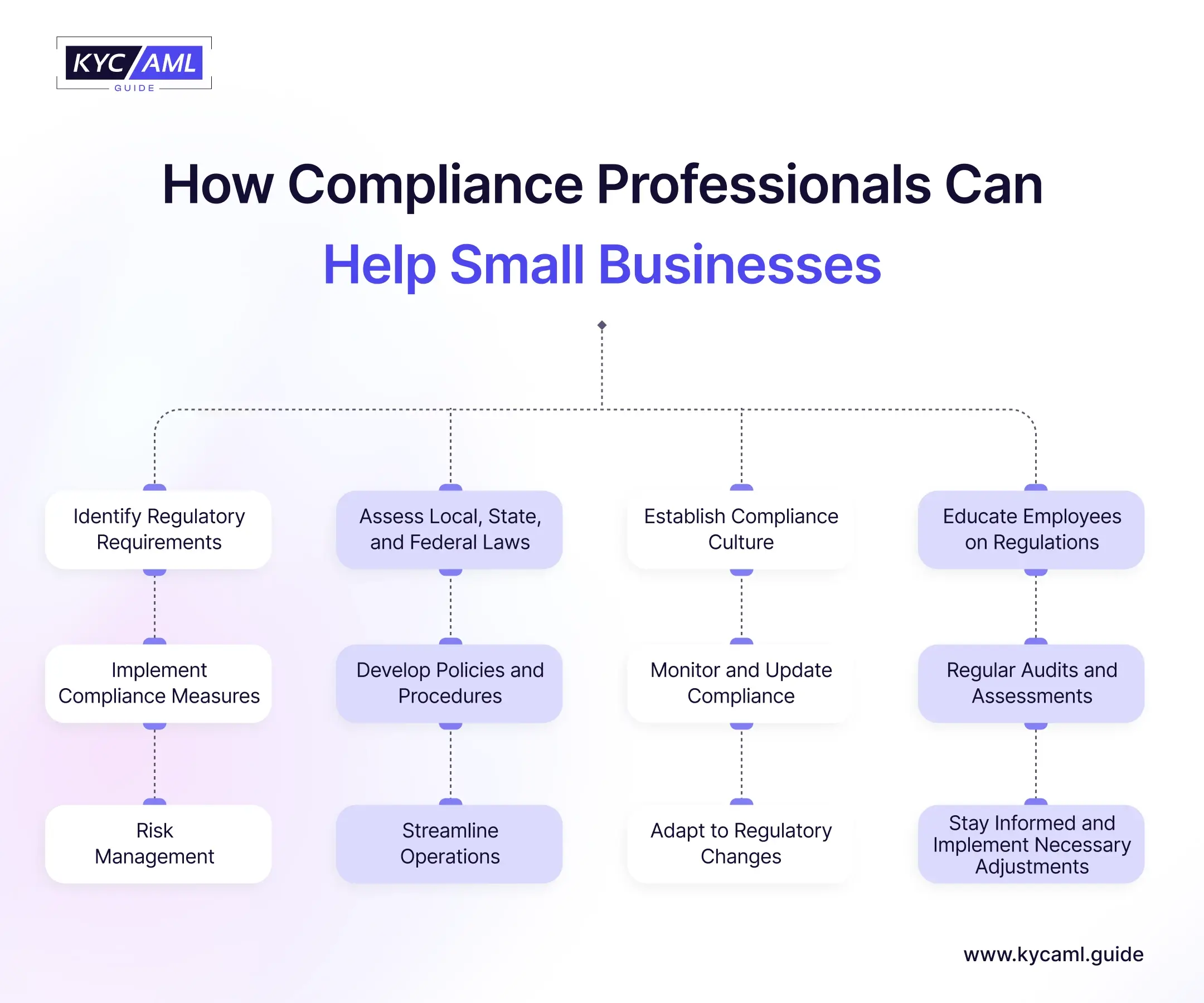

How Compliance Professionals Can Help a Small Business?

Although hiring a compliance professional may cost time and money, it is well worth the effort and investment. Below are some important things they can do to ensure compliance within their organization:

1 Identify Non-Compliant Areas.

Recruiting or consulting an experienced compliance professional can be of extraordinary advantage to your small business. Based on your particular necessities and the size of your budget, you can hire a compliance professional, Then again, you can likewise outsource your compliance services. It guarantees that your practices, strategies, and records are routinely reviewed by qualified experts to guarantee compliance with regulations and laws.

2 Staying Up-To-Date on Changes to Laws and Regulations.

Knowing and seeing every one of the regulations and laws that apply to your business can be a test. Employing a compliance professional can furnish you with advice, updates, and warnings about changes in laws and guidelines that influence your business. To stay informed of upcoming events, it’s also a good idea to sign up for email lists or newsletters provided by government agencies. You can likewise use compliance software solutions that provide automatic updates and relevant changes.

3 Risk Management.

Risk is faced by almost all organizations and the important way of sustainable growth is effective risk management. The task of identifying potential risks rests with compliance professionals and also methodologies to mitigate those risks created by them. If organizations take considerations regarding compliance issues, they safeguard their tasks, increase their stability, and a foundation will be set for long-term success.

4 Streamlining Operations.

Business performance is improved by taking into consideration compliance measures that are not just to tackle legal issues. Compliance professionals help companies enhance their KYC procedures, improve inefficiencies, and cut unnecessary costs. The growth of small-scale businesses’ allocation of resources is managed by the proficiency of compliance professionals.

5 Training of Employees.

Creating compliance policies and procedures is mandatory, but not sufficient by itself. To ensure effective compliance, you must have your employees communicate openly and train them on your policies. Effective and engaging employee training can be provided online or in person and can be facilitated by your compliance team or an external compliance professional.

Also Read: 5 Key Skills to Look for When Hiring Compliance Professionals

Importance of Compliance Training for Small Businesses

Compliance training is important for teams of all sizes. When considering a small business, compliance training is important because many small businesses operate in a more informal manner than large corporations, but laws and regulations also apply to small businesses. Compliance training allows small businesses to follow their approach to directing their employees through guidelines and regulations. As per North Row, Compliance training is the top priority for 42% of teams in 2023. Other reasons why compliance training is important for small businesses include but are not limited to:

1 Keeping Employees Informed

Awareness is a step toward compliance. With the right compliance training, you can ensure that your employees know the rules they must follow, the code of conduct they must maintain, and their responsibilities in the workplace.

2 Safeguarding Against Non-Compliance

Non-compliance not only damages your company’s reputation but also poses financial and operational risks. Compliance training is the best way to inform your employees about the consequences of non-compliance.

3 Maintain Better Compliance

Informed staff and good standards will help you get better compliance in the future. Businesses do better when there is better compliance training.

Compliance as a Service (CaaS) by KYC AML guide

KYC AML guide is offering a CaaS marketplace service that can save small businesses time and money and give them access to compliance professionals who can simplify their work and make compliance easier.