Overview of Digital Currency

Digital Currency refers to intangible money that exists virtually in online accounts of users. It is also known as virtual currency or virtual asset. Given its rapid rise, cryptocurrency has become a prominent target with inherent risks related to money laundering and terrorism financing. Due to multiple factors, regulating cryptocurrency is far more challenging than cash-backed financial system.

Main AML Challenges Faced by VASPs in Digitizing Financial Services

While implementing an AML (Anti-Money Laundering) strategy, Virtual Asset Service Providers (VASPs) can face 5 major challenges:

1 Sophisticated Money Laundering Techniques

Financial crime is ever-evolving and criminals adapt to new methods to circumvent the AML Controls. They use cutting-edge counter technologies and cryptocurrency to hide illicit money and make complex transactions.

Surprising News: Cryptocurrency Theft Worth $35 Million Is Suspected To Be The Work Of North Korean Hackers

2 High Number of Transactions

Banks, Financial Institutions, and MSBs directly deal with a high volume of transactions every minute. Thus, identifying suspicious transactions among a large number of legitimate transactions is a significant challenge. Cryptocurrency is becoming increasingly popular and a large population is embracing it as theri financial avenue. Large numbers are transacted everyday through cryptocurrency exchanges that pose significant financial crime risks.

3 Regulatory Compliance Pressure

The regulatory compliance ambiance changes constantly due to regular updates by the authorities. Every day KYC/AML compliance is becoming more stringent. Both Cryptocurrency Exchanges and Fintech firms have to keep up with these updates and adapt to the changes in compliance accordingly. Also, they are required to implement AML policies and procedures across their organization and make investments in compliance training. This is a challenging task for growing fintech firms.

4 Privacy Issues

Anti Money Laundering procedures require sharing of sensitive information and personal data with regulatory authorities. It compromises the customer data privacy and protection element that is mostly promised by financial institutions. So, keeping a balance between compliance and privacy is another big concern for AML regulators.

What are Major Cryptocurrency Issues and Challenges?

In May 2023, the World Economic Forum published a white paper named Pathways to the Regulation of Crypto-Assets that summarizes the Potential challenges and effective solutions in Regulating the Crypto-Assets Globally. The key takeaways of the report are as follows:

| 1 | Emphasis on Global Coordination for Crypto Regulation is necessary but challenging to achieve. |

| 2 | An Alternative Regulatory Strategy should be devised for Crypto Ecosystems by Industries and Regulators. |

| 3 | Promotion of Harmonic Understanding of Crypto-Assets Internationally and Fostering Data-Sharing through Interoperability. |

| 4 | Coordination Between Regional & National authorities to leverage technology and analytics in automating regulatory compliance. |

| 5 | Jeremy Allaire, Co-Founder & CEO of Circle emphasized the importance of regulatory engagement and policy harmonization for digital currencies. |

| 6 | Michael Granger, Co-Founder and CEO of Chainalysis highlighted the crypto-asset movements and how they aim to revolutionize the global economy. He appreciated the World Economic Forum’s report and viewed it as a concrete step towards regulating the crypto industry. |

| 7 | Deepa Raja Carbon, the MD and Vice Chair of VARA UAE emphasized the need for clarity and certainty to enable a sustainable future for virtual assets. She stressed harmonizing the rules across the global virtual assets and markets. |

| 8 | Oleksiy Feshchenko, Advisor to the Global Program against Cybercrime (UNDOC) stressed the importance of coordinated efforts to regulate cryptocurrencies among jurisdictions globally. He raised an alarming concern about the lack of regulation in certain exchanges that is hindering the fight against cybercrime through cryptocurrencies. |

Cryptocurrency is a digital asset that is directly related to the AML Challenges faced by fintech firms. Regulating Crypto Assets includes the following major concerns:

1 Anonymity & Privacy Concerns

Cryptocurrencies enable a high level of anonymity in transactions which makes it challenging for AML regulators to identify the owners of assets. This can facilitate illicit activities like Money Laundering and Tax Evasion. Maintaining a balanced approach between regulatory compliance and customer data privacy is mandatory while regulating crypto assets.

2 Lack of Uniform Global Regulation

Since Cryptocurrencies operate in a decentralized environment, it makes it challenging for building a unified global regulatory framework. This hinders the effective oversight of virtual assets.

3 Volatile Markets & Risks to Investors

Another AML Challenge in Regulating Crypto Assets is the high level of volatility in crypto markets. This poses a risk to investors where regulatory measures cannot fully address market manipulation and fraud.

4 Cross-Border Transactions

The existence of cryptocurrencies is digital making them an easy way out for seamless cross-border transactions. This helps the money launderers in bypassing financial security systems and regulatory laws.

Discover more about Crypto Travel Rule by KYC AML Guide

5 Complex Technologies

Embracing newer technologies is not always easy or beneficial. Sometimes it can cost more than the designated budget and weaken the financial backing of an ecosystem. For example, blockchain technology is highly complex and not easy for everyone to understand. Similarly, traditional regulatory frameworks are still working and find it difficult to regulate crypto assets in many jurisdictions.

6 Regulatory Compliance Gaps

Global regulatory bodies are still lagging behind in completely regulating cryptocurrency due to the factors of newness and anonymity. Moreover, different jurisdictions classify cryptocurrency under different categories such as commodities, currencies, and or securities. This leads to a fragmented regulatory approach that cannot work effectively.

But FATF’s updated guidelines on VAs and VASPs promotes the implementation of Travel Rule and monitoring of market trends to standardize the virtual currencies across different platforms.

7 DeFi & NFTs

The tokenization (Non-Fungible Tokens) and rise of DeFi (Digital Finance) platforms have also made it challenging for AML regulators to regulate virtual currencies.

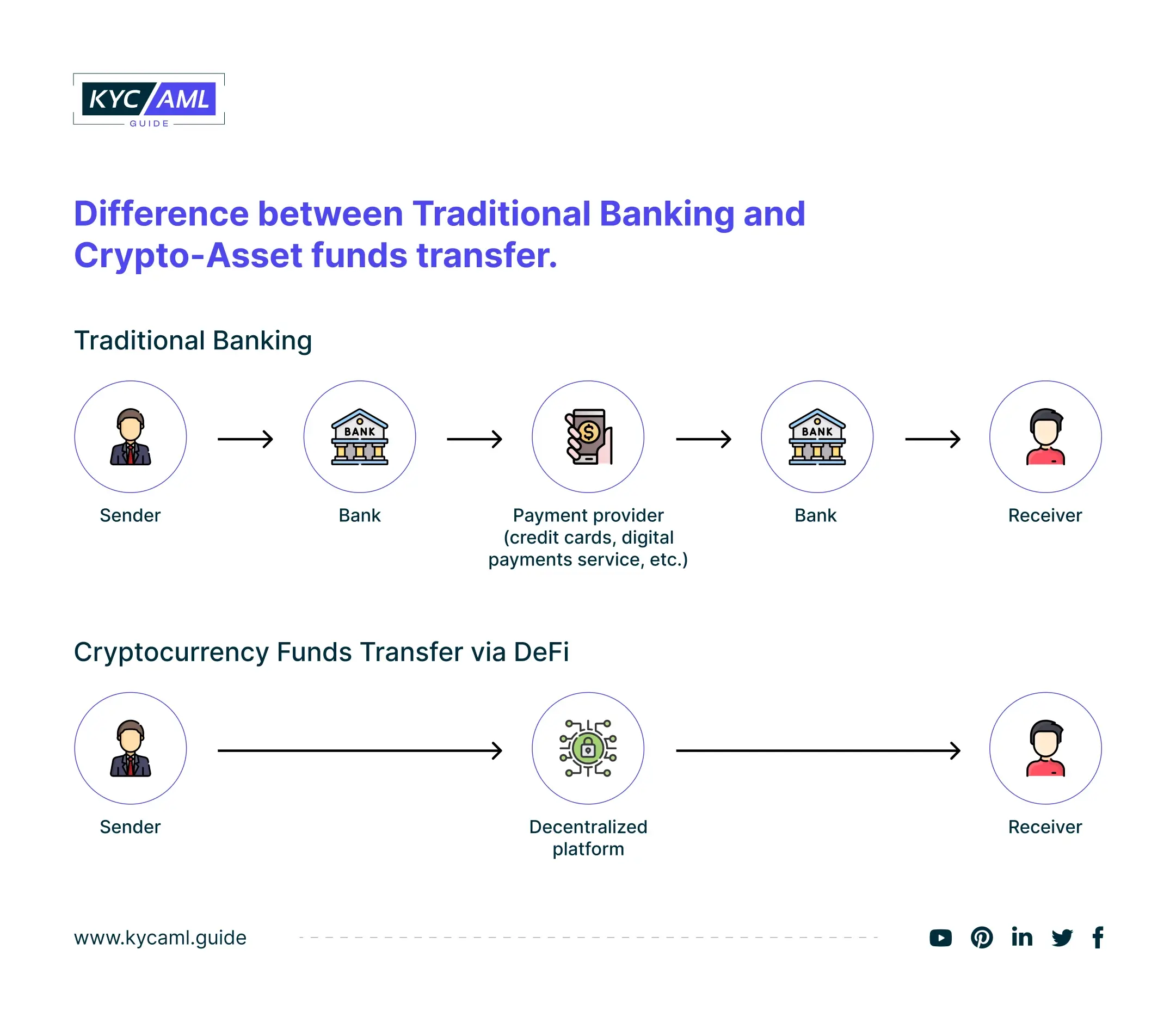

Difference Between Traditional Banking & Crypto-Asset Funds Transfer

The above shown visual demonstration shows how a Traditional Banking Service and Cryptocurrency transfer funds. In the case of a bank transfer, the transaction flows from sender to receiver involving 5 parties in the following order:

- Sender

- Sender’s Bank

- Payment Service Provider

- Receiver’s Bank

- Receiver

In the case of a crypto-asset fund transfer, all the central activity between the sender and receiver is limited to a complex Decentralized Platform that is based on blockchain technology.

Dive into the realm of Blockchain-Based IDV Systems and know how they can help in regulating Crypto Ecosystems.

Crypto Regulatory Analysis Overview

World Economic Forum also analyzed different regulatory approaches and published the results in Table 8 of the white paper as mentioned previously. 4 types of regulations are discussed below:

- Outcome-Based Regulation

- Risk-Based Regulation

- Agile Regulation

- Self and Co-regulation

- Regulation by Enforcement

The results of the qualitative study showed that overall Risk-Based and Agile Regulation topped the numbers and are preferred regulatory approaches for Crypto Ecosystems.

Conclusion

(Anti-Money Laundering) AML Challenges in a Digital Landscape require innovative approaches and adaptive solutions to mitigate the ever-evolving risks of Money Laundering and Terrorism Funding. Money Laundering through Cryptocurrency is becoming a rising concern for regulatory bodies across the world. So, to mitigate this risk, collaborative and coordinated global efforts are required for regulating cryptocurrencies under the mutually agreed category of KYC and AML regulations. The Fintech firms need to recognize the growing need for virtual currency and their regulation for financial security. A robust KYC (Know Your Customer) and AML (Anti-Money Laundering) system can help Fintech firms in achieving compliance goals that are aligned with the regulatory requirements.

An automated KYC and AML System streamlines the customer onboarding process and protects the financial systems for legitimate users while maintaining a high level of security. The right balance between customer satisfaction and strict security is critically important in resolving the challenges faced in implementing AML policies.

Also Read: The Role Of Cybersecurity In KYC and AML